As we will welcome the New Year soon, I’ve decided to take some time to look back at everything I’ve worked on this year—my writeups, their results, and the ideas that still hold big potential for 2025. First off, I want to thank everyone who’s subscribed and interacted with my content. It’s been less than six months since I started this journey, and the growth has been unreal. Right now, we’re at 666 subscribers (fingers crossed I don’t end the year on that number!) and over 1,000 followers.

2024: A Year of Growth and Transformation

This past year has been a whirlwind. I’m gearing up to start raising capital for my fund, Twelve and Eight Capital, which I co-founded with a good friend. On top of that, big changes are coming to Undervalued and Undercovered. I’m super excited (and a little nervous) to announce that I’ll be introducing paid subscriptions on Substack.

Why the switch? I want to bring even more value to everyone who’s been supporting me. The paid subscription will include exclusive portfolio updates, insights on the companies I cover, and access to some of my best thesis work. Free content isn’t going anywhere, though—I’ll still share writeups and insights to help as many people as possible.

The paid subscriptions will also help fund Twelve and Eight Capital. A stable cash flow will allow us to expand the team and take things to the next level.

Looking ahead to 2025, I’m planning to step up my game. I want to include interviews with investors and company management teams in my content lineup. I’m committed to delivering even more value to everyone following along.

Reviewing the Model Portfolio Performance

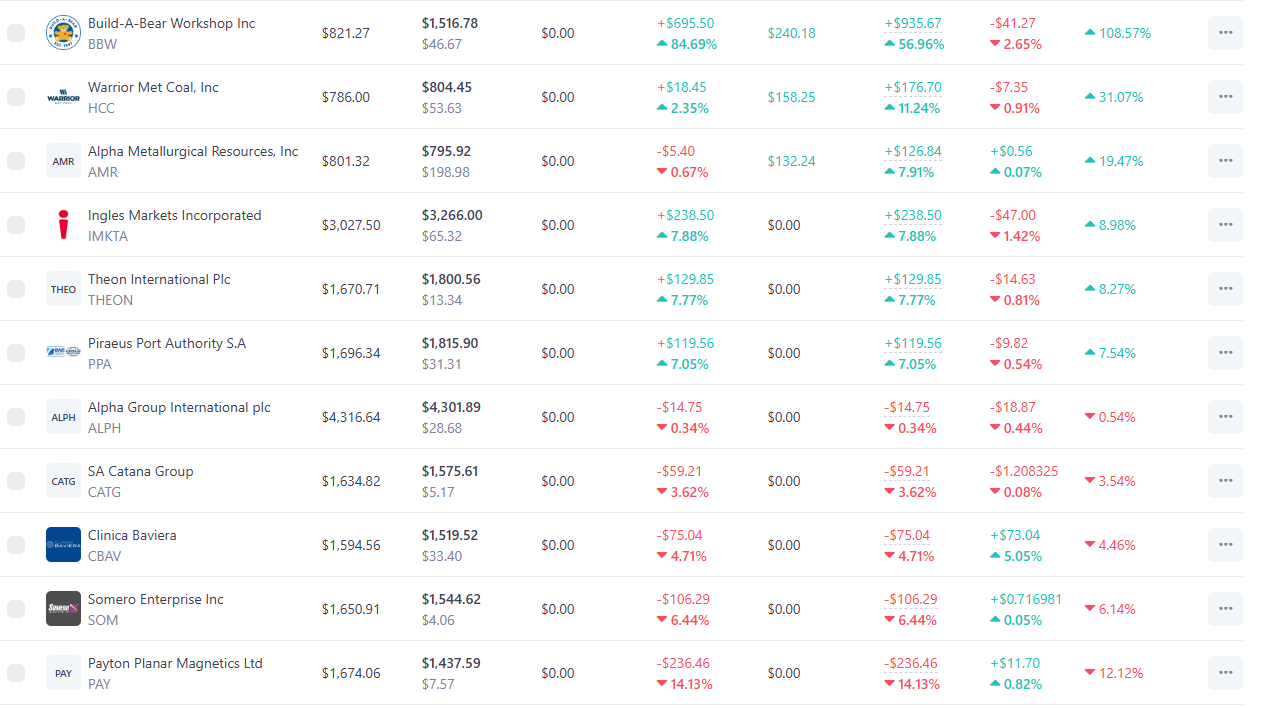

Now, let’s dive into the numbers. The model portfolio’s performance has been solid, though there’s room for improvement. I’ll admit, I haven’t been able to update the portfolio as often as I’d like, which means I missed adding a few big winners. Despite that, I’m really happy with how things have gone so far.

For those new here, I launched the portfolio on October 2, buying every company at the price when I first published my thesis. I’ve been making transactions in real-time through the notes section of Substack. For fairness, I’ll measure performance starting August 1, since the portfolio was less than 10% invested before then.

Choosing the right benchmark to measure against isn’t easy, but I think the VOOV (S&P Value Index) is a solid choice.

The Results

Without further ado, here are the results of the portfolio over the past five months.

I’m thrilled to share that our portfolio delivered a 6% gain over the past five months, compared to the 1.9% gain of the S&P Value Index (VOOV). Considering that many of the companies I’ve invested in are still flying under the radar, I think these are pretty solid results. It’s early days, and I’m confident some of these picks will shine even brighter as the market starts to take notice.

What is our current allocation?

Next week, I’ll be publishing an article to kick off 2025 with some updates to the portfolio. There are several exciting companies I’m planning to add, and I think it’s a perfect time to position ourselves for another strong year.

In addition to portfolio updates, I’ve also written extensively about other companies outside the model portfolio. So, let’s take a quick look back at the three best performers and the three worst performers from my writeups.

Top 3 Performers

Build-A-Bear Workshop: A remarkable 85% gain since I published my thesis.

Payfare: Delivered a solid 80% gain.

Intellego Technologies: Impressive performance with a 57% gain.

Bottom 3 Performers

Mammoth Energy Services: A disappointing -38% loss.

XLM: Down 28%.

KSS: A loss of 21.7%.

Interestingly, as we head into 2025, I find some of these underperformers quite attractive and may consider adding them to the model portfolio. After all, great opportunities often arise in areas the market overlooks.

Planning for 2025

Overall, I’m pretty satisfied with how things have gone so far. That said, I believe our holdings still have a lot to prove. Looking ahead, I’ll be making several adjustments to the portfolio, including increasing the number of names to better diversify and capture more opportunities.

Hidden Gems at Lower Valuations

Now, let’s talk about some of the companies I’ve written about that are currently trading at cheaper valuations than when I first covered them. My favorite among them is Alpha Group. Many of you are already familiar with this one—it’s a company with incredible fundamentals trading at what I consider a ridiculous valuation.

I think that this might be my favourite pick going into 2025.

Additionally, we’ll need to discuss the PGM market. I believe platinum, palladium, and Sylvanna present significant upside in the coming years. These metals are poised to become key positions in my portfolio moving forward.

Do not forget about companies near or below NAV with turnaround possibility like KSS or ALICO

We also have THEON international which has seen a huge upside in price over the last few monhts, the company is still really undervalued and could have a great 2025.

Theon International: Aggressive Growth in the Defense Sector.

Investment ReportThanks for reading Undervalued and undercovered! Subscribe for free to receive new posts and support my work.

We also have THEON International, which has experienced a significant upside in price over the last few months. Despite this growth, the company remains highly undervalued and holds great potential for 2025.

Overall, I think I’ve provided a solid summary of the best companies to watch for next year, and I’m pleased with the performance of our model portfolio so far. I’m confident that 2025 will be an amazing year for Undervalued and Undercovered. You’ll gain access to hedge-fund-level insights, follow my progress with Twelve and Eight Capital, and, hopefully, we’ll uncover some ten-baggers along the way.

👏