Investment Report

LON: SOM

Market capitalization: 183.2 million pounds

Stock price: 3.39£

P/E ratio: 8.7

Div yield: 7.19%

Key points:

Average ROC of 46% over the last decade and average ROA of 25% over the same period.

High gross and operating margins that have been stable over the years.

Market leaders in a niche market where they have a big moat.

As a market leader in its niche, Somero Enterprises is set for extensive growth. While North America currently generates 73% of its revenues, the company is vigorously pushing for global expansion.

1. Overview:

Somero Enterprises, Inc. is a leading global company specializing in the design, manufacturing, and distribution of laser-guided concrete leveling equipment. Established in 1985 and based in Fort Myers, Florida, Somero has been a trailblazer in the concrete construction sector. The company has a notable international footprint with satellite locations in Michigan, India, Australia, the United Kingdom, and Belgium, and it is listed on the Alternative Investment Market (AIM) of the London Stock Exchange under the ticker SOM.

Somero's product range includes ride-on, stationary, boom, and lightweight screeds—specialized equipment designed to ensure concrete surfaces are level and smooth. This precision is essential for large-scale construction projects like shopping malls, airports, and factories, where even small deviations in leveling can affect structural integrity. The use of advanced laser technology in Somero's equipment enhances the quality of concrete placement, making the process more efficient and cost-effective.

In addition to screeds, Somero provides boom and cure machines, line pulling and placing systems, topping spreaders, and offers comprehensive training services, parts, accessories, and software platforms. Since its founding, Somero has expanded its product offerings to include +20 different items, secured by 129 patents, reflecting its dedication to innovation and industry excellence.

Somero's equipment is used in a variety of construction projects for some of the world's largest companies, such as Costco, Wal-Mart, Home Depot, and Tesla. With a workforce of over 300 employees and operations in more than 90 countries, Somero continues to expand its global sales and service network, providing top-notch support and training to a diverse client base ranging from small businesses to large corporations and municipalities.

2. Products:

Their most popular products are the boomed screed and the ride-on screed, last year they produced more than half of the total revenue of the company.

Here is a list with all the products that the company offers:

2.1 Boomed screeds:

‘The boomed Laser Screed products are powerful, easy to transport, and come complete with our full technical support and expertise. So you can make some major efficiency gains on the projects where it matters most.’

2.2 Ride-on screeds:

‘With incredible pulling power and the OASIS control system, the S-485 is a ride-on four-wheel drive model that can screed in any direction and is easy-to-operate.’

This video explains perfectly what Somero offers: more productivity and fewer costs.

3. Business model:

Somero Enterprises, Inc. employs a distinctive business model that significantly contributes to its niche in the concrete construction industry. By focusing on design and assembly, while outsourcing manufacturing, Somero achieves an asset-light approach, resulting in high gross margins and substantial free cash flow.

Somero is a pioneer in laser-guided screeding machines, having introduced its groundbreaking Laser Screed® machine in 1986. The company has since expanded its product lineup to include over 20 different designs protected by 129 patents, reflecting its commitment to innovation and market leadership. This dedication is fueled by active customer engagement and a focus on continuous product improvement.

The company offers comprehensive support and training for its products, including 24/7 classroom and job-site training available in all major languages. This support structure is enhanced by a commitment to rapid service responses and quick spare parts delivery globally, ensuring high levels of customer satisfaction and equipment reliability.

Somero's international reach includes selling products in over 90 countries, with a strong sales concentration in North America. Its machines are used across a diverse range of construction projects, including warehousing, industrial and manufacturing sites, schools, hospitals, commercial complexes, retail centers, and parking structures. This versatility ensures broad applicability and sustained demand for Somero’s offerings.

The brand’s reliability and effectiveness have attracted an impressive array of global clients, including major corporations like Walmart, Home Depot, B&Q, and Tesla. These high-profile clientele not only enhance Somero’s market credibility but also demonstrate the widespread trust and dependency on its technology.

By strategically focusing on technological innovation, global market presence, and comprehensive client support, Somero’s business model not only meets the current demands of the construction industry but also adapts to future challenges, securing long-term growth and stability. This approach positions Somero as a leader in its field, well-equipped to capitalize on emerging opportunities in the global construction sector.

4. Competitive advantages:

Somero is the main player on a niche market that they have created, there is minimal competition, and all their products are IP protected, with the company holding 129 patents.

They have a close relationship with their clients allowing them to improve their products according to their needs which further deepens their relationships with their clients.

Somero does more than sell equipment, they provide access to training to all their clients, teaching them to use their products in person or online and in more than 12 different languages.

Think how difficult it could be for a competitor to introduce a product where most existing clients have been trained to use Somero’s products.

They have a huge moat thanks to their market leading position, IP protected products and the cost in time that would cost their existing clients to change to a competitor.

5. International expansion:

Currently the company brings most of their revenues from North America, this is slowly starting to change as the company continues to invest in international expansion, there is a lot of revenue growth that the company could get if they are able to successfully enter new markets.

Last year North America revenues were down but Europe and Australia revenues were up, Australia saw a 18% revenue growth YoY.

5.1 Europe

Somero is growing on Europe with 15.1M in revenue coming from there, 39% of revenue comes from new customers, this means that they are increasing their client base all over Europe. They have started selling on Germany, Italy and the Czech Republic and plan to add a new training and service center in Belgium in 2024.

5.2 Australia

Growth in Australia has been fast over the last years, revenue from new customers represented 62% of the total revenue coming from Australia, once a client buys one of their products, they get used to it and become recurrent buyers. In addition to that in-country team has increased to 11 people.

6. Leadership:

Mr. Cooney, age 77, has led Somero Enterprises, Inc. as CEO since 1997 and has been a director since 2005. With over 45 years of experience in senior management roles, he has a deep understanding of the industrial equipment sector. Before Somero, he was CEO of Advance Machine Company and held executive roles at Ganton Technologies.

Mr. Cooney holds an associate’s degree in industrial engineering and an MBA, providing a strong foundation for his leadership. He owns shares in Somero valued at 2.1 million pounds, aligning his interests with those of shareholders. This significant ownership stake ensures that his financial success is directly tied to the company’s performance, fostering confidence in his commitment to enhancing shareholder value.

7. Dividend policy:

The company dividend policy is based on adjusted net income and excess net cash. The ordinary dividend payout is 50% of adjusted net income and the supplemental dividend is 50% of net cash in excess of 25 million. This dividend policy is beneficial for shareholders as they receive a substantial amount of the company’s earnings as dividends, furthermore this dividend policy is conservative enough to make sure that the company has enough cash reserves and retained earnings to invest in growth opportunities.

Last year the ordinary dividend was 0.232$ and the supplemental dividend was 0.074$.

The company’s dividend has increased five-fold since 2014 this strong dividend growth has been the result of the business increasing revenues and profits and the management increasing the dividend payout ratio.

8. Financial Performance:

Margins and Costs:

Somero has great gross and operating margins, consistently achieving +54% gross margins over the last decade and averaging 30% operating margins over the last 7 years, the company is able to maintain this margins thanks to their strong moat and leading market position.

Revenue Growth:

The company has grown their revenue from 59.28 million dollars to 120.7 million dollars over the last decade, most of this revenue growth came from North America. For this year they expect revenue to decrease to 110 million dollars due to a challenging environment.

High returns on capital:

The company has achieved amazing ROC and ROA.

ROC averaged 46.05% over the last decade and ROA averaged 24.95% in the same period.

9. Thesis:

Somero Enterprises, Inc. experienced varied performance across its global markets in H1 2024, therefore the company issued a weak guidance for the full year causing the stock to drop. The European market remained active, benefiting from positive non-residential construction conditions and robust project backlogs, resulting in trading levels comparable to H1 2023. In contrast, Australia faced inclement weather that delayed projects, leading to a decline in trading compared to a record performance in H1 2023. Additionally, trading in the Rest of World region decreased, primarily due to lower sales volumes in the Middle East and Latin America. The company noted that fluctuations are expected due to the relatively small base of business in these regions.

The stock decline can be attributed to a challenging market environment and lower-than-expected demand. Somero revised its projections for FY 2024, with expected revenues of approximately $110 million and an EBITDA of $30 million, down from previous market consensus estimates of $120.7 million and $34 million, respectively. Additionally, the company announced a 15% workforce reduction to align with reduced revenue expectations, which, along with strict cost controls, aims to mitigate the impact on profitability.

Despite these short-term challenges, the company’s long-term prospects remain intact, international expansion will bring revenue growth to the company, and it is likely that the company will be able to maintain their historical margins thanks to their strong and growing moat, markets like China and India could add a lot of earnings If the company is able to introduce their product into these markets.

The current valuation is cheap and there is room for multiple expansion once the company recovers from the current downturn.

10. Valuation:

To value the company, I have forecasted the company 10 years into the future with these assumptions:

Revenue: I assume that the company will grow their revenues at a 7.5% CAGR from 2025 to 2028 and at a 5% CAGR from 2029 to 2033.

Margin expansion: I expect the company to maintain its current margins over the next decade, recovering slowly from the bad results expected from this year.

Capex: I expect capex to remain low as most of the company’s costs are OPEX.

Taxes: I anticipate that the tax rate will go back to 23%

These assumptions are very conservative and will give us a target price for the stock that is based on reality and that reflects a quite challenging environment for the company, it is possible that the company performs much better than these assumptions, but for the sake of estimating the value of the company we cannot expect the group to grow as fast as the last decade.

These are the income and cash flow statements forecasted until the year 2033:

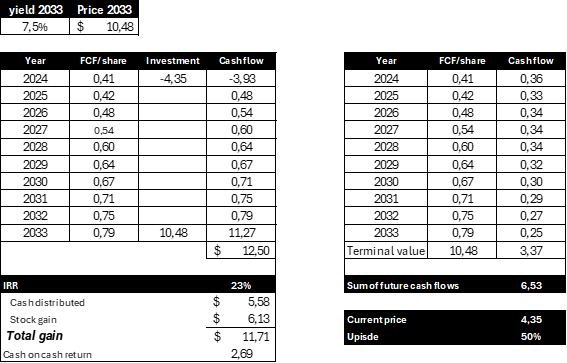

To achieve a valuation, I have built an IRR model and a DCF model.

The company reports their revenues on dollars but is based on a UK exchange, therefore I must adjust the share price in pounds (3.4 pounds) to dollars (4.35 dollars).

According to the DCF that I made (assuming a WACC of 12%) the stock has an 50% upside at current prices. This means that we can buy the stock with a big margin of safety.

11. Conclusion:

Somero Enterprises thrives in what many consider a "boring" industry, yet this niche offers a competitive advantage. Most investors do not invest in companies like this one because they think they do not offer amazing growth prospects like tech does, however this creates a great opportunity for value investors to invest at low valuations.

Cement, the world's second most consumed commodity, underscores the constant demand for Somero's products. The company has a strong management, high operating margins, great returns on capital and a robust dividend.

While potential challenges such as U.S. interest rate increases and transitions in key management roles loom, these risks seem well-reflected in the current valuation, making Somero a compelling buy for steady growth over the following years. This combination of reliable industry positioning and strategic growth initiatives makes Somero a solid investment prospect.

Hi Hugo, thank you for the analysis. I got interested as well and decided to dig deeper.

What do you think about their performance in the aftermath of financial crisis? It seems they were hit pretty hard in the slowdown - their EPS was negative for 3-4 years. And they could recover only after 5-6 years. Seems to be a cyclical stock. It's quite dangerous to buy cyclical when things look good (they started looking a bit worse now, but are still fine).

Another point is that they have kind of a "one-shot" product in my opinion. When somebody buys such a machine, he normally does not need a next one for quite some time (maybe never?) Somero constantly needs to find new customers not just to grow, but to keep the current level of earnings/revenues. Just look at the numbers in their presentation (H1 2024) - they show that new customers represented 18% and 43% in Europe and Australia respectively. And even with such a big growth in new customer they still experienced a slowdown/stagnation in both regions.

What is your take on these points?

Thanks for this excellent analysis Hugo. Do you have any insight into management succession, in view of 77yr old CEO?