Alico: Buy Land In Florida, Bet on Oranges: Alico’s Double Catalyst Play

Bear Case 2x, Bull Case 3x: The Math Behind Alico’s Opportunity

Investment Report

Key points:

Dual Value Drivers: Alico’s future hinges on two major opportunities – a citrus business turnaround and strategic land sales.

Land Value Safety Net: Vast land holdings in Florida, acquired at minimal cost, provide downside protection and steady appreciation.

Aligned Management: Incentives tied to ROIC and share price ensure management prioritizes shareholder returns through buybacks, dividends, or strategic sales.

Low-Risk, High-Reward: Limited risks and a clear path to value make Alico an attractive investment with market-beating potential.

1. Introduction:

Alico, Inc., a Florida-based producer of oranges, stands at the intersection of opportunity and adversity in the agricultural industry. Renowned for its role in the state’s citrus production, Alico is a company deeply rooted in a sector that has faced unprecedented challenges in recent decades. These challenges have been compounded by environmental, economic, and biological factors, reshaping the trajectory of the company and the broader Florida citrus industry.

One of the most significant hurdles has been citrus greening disease, a bacterial infection spread by tiny insects called psyllids. This disease has devastated Florida's citrus groves, leading to a dramatic decline in orange production, which fell from 220 million boxes in 2004 to a mere 16 million boxes in recent years. In response, Alico has adopted innovative methods to combat the disease, including the use of oxytetracycline injections to treat its trees. While these treatments have shown promise in improving yields, the fruit quality and reduction in fruit drop have yet to recover fully.

Adding to this biological crisis, hurricanes have wreaked havoc on Florida's citrus groves, causing extensive damage and exacerbating already strained production. Alico itself suffered over a 50% decline in citrus harvest due to hurricane Ian, and the company anticipates that it will take at least another growing season for its groves to recover.

Compounding these issues is the backdrop of global inflation, which has driven up costs for essential inputs such as fertilizer, herbicides, labor, and fuel. These rising costs, paired with decreased production levels, have placed immense financial pressure on Alico, significantly impacting its profitability and weighing heavily on its stock price.

Despite these challenges, Alico’s most intriguing asset is not solely its citrus operations but its extensive land holdings. The company owns 53,371 acres in Florida, a state experiencing rapid population growth. The value of this land alone exceeds the current enterprise value of the company. In the past, Alico has successfully monetized portions of its land, selling approximately 50,000 acres, and it is now preparing another attractive parcel for sale. This unique land asset has drawn the attention of value investors, making Alico a popular stock among those seeking opportunities in undervalued companies.

Alico even appeared in the famed investment book One Up on Wall Street by Peter Lynch, underscoring its historical appeal as a value play. However, the combination of ongoing citrus production challenges and a lack of strong catalysts has kept the stock trading at levels reminiscent of the early 2000s. Still, any substantial positive developments in the citrus business or the successful monetization of its land assets could reignite investor interest and transform Alico into a compelling turnaround story.

This thesis delves into the interesting opportunity that Alico offers combining the turnaround potential of their orange business with their land holdings which are worth alone almost double the current EV of the business.

2. Land value:

Alico's most compelling asset lies not in its citrus groves but in its vast land holdings across Florida. According to the company’s latest investor presentation, Alico owns approximately 53,371 acres of land and has partial or full rights to about 48,700 acres of oil, gas, and mineral reserves. These land assets represent a significant portion of the company's intrinsic value and offer a unique hedge against the challenges faced in its agricultural operations.

While valuing land can be inherently complex, past sales and market trends provide a reliable framework for estimation. Florida’s population growth, along with increasing demand for real estate, suggests that the value of Alico’s land is steadily appreciating. For example, farmland in Florida has demonstrated an average compound annual growth rate (CAGR) of 6.6% over the past two decades, according to AcreTrader. This upward trend is underpinned by several factors, including:

Rapid Population Growth: Florida remains one of the fastest-growing states in the U.S., attracting new residents, businesses, and infrastructure investments.

Tourism and Business Expansion: Florida’s thriving tourism sector and business-friendly climate continue to drive demand for land.

Limited Supply of Developable Land: With less than 20% of Florida’s land open for development, scarcity further enhances land value.

Alico is currently preparing to sell a 4,500-acre grove near Fort Myers in Collier County, one of Florida’s fastest-growing counties. This parcel represents a prime real estate opportunity and is likely one of the company’s most valuable holdings. As Florida’s population and economic activity continue to expand, the strategic location of this land makes it an attractive asset for buyers seeking development opportunities.

Being pessimistic the value of Alico’s land stands at $460 million—a figure grounded in conservative historical sales data and market trends—it becomes apparent that the company’s current enterprise value of $300 million significantly undervalues these holdings. At this valuation, investors essentially gain access to appreciating land assets with minimal downside risk, given their steady value growth in mid-single digits annually.

The key challenge for Alico lies in bridging the gap between its fair value and its current stock price. Successfully monetizing its land assets, such as the upcoming sale in Collier County, could serve as a critical catalyst for this revaluation. However, to unlock its full potential, the company must also address the difficulties in its citrus business, which could provide additional upside beyond the inherent value of its land holdings.

3. Cytrus production:

Florida's orange producers, including Alico, have faced unprecedented challenges in recent years. Citrus production is at an all-time low due to a combination of natural disasters and persistent biological threats. Events such as Hurricane Ian and an intense freeze slashed production by more than 50%, pushing an already struggling industry further into crisis. Despite these obstacles, several factors suggest that Alico's citrus operations could represent a turnaround opportunity in the coming years.

The Current Landscape: Struggles and Opportunities

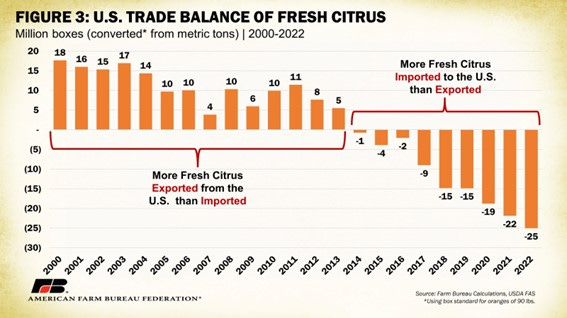

While production has been severely hampered, recent developments in the market provide a glimmer of hope. Alico's contracts with major juice producers, such as Tropicana, have been renegotiated with significantly improved terms, securing prices that are 33% to 50% higher than previous agreements. This price increase comes at a time when orange supplies from Brazil and Mexico, major competitors, are also declining. Additionally, tariffs on imported oranges provide a competitive edge for U.S. producers. Given the current U.S. deficit in orange supply, any increase in Alico's production is likely to be well-absorbed by the market.

Future Production Potential

Alico is positioned to rebound in the next few years as new and existing trees mature. The company has planted additional trees annually, resulting in a +20% increase in total tree count. Many of these trees are still young and are expected to reach full production capacity between 2025 and 2027. Once this happens, production could grow significantly, with estimates suggesting that no less than 2.2 million trees will be in full production.

In an effort to combat citrus greening and enhance productivity, Alico has treated 4.5 million producing trees with oxytetracycline (OTC). While the exact effects on yield remain uncertain, additional rounds of treatment are expected to boost productivity per tree. With 35% of trees treated for a second time in 2024, the company may see incremental improvements in output as early as 2025.

Cost Structure and Profitability

The cost side of Alico's orange business presents both challenges and opportunities. Inflation has driven up the cost of key inputs like fertilizer, labor, and fuel. However, this has been partially offset by higher orange prices, driven by stronger juice contract terms and market demand.

Alico operates with a relatively fixed cost base. Total costs are estimated to range between $120 million, broken down as follows:

Fixed Costs: ~$75–86 million in COGS in addition to $12 million in general and administrative costs and $3–4 million in interest expenses.

Variable Costs: ~10–20% of revenue, primarily associated with harvesting and handling.

With conservative estimates, Alico could return to producing between 8–10 million boxes annually by 2026 or 2027. At an average realized price of $3.50 per pound solids (driven by improved pricing with Tropicana) and assuming five pounds of solids per box, Alico’s annual revenue could reach $140–175 million.

Using an average of $95.5 million in fixed costs and 15% of revenue for variable costs:

Revenues: $140–175 million

Variable Costs: $21–26 million

Fixed Costs: $95.5 million

Profits Before Taxes: $23.5–53.25 million

Alico’s citrus business represents a classic turnaround story. The combination of improved market dynamics, maturing tree investments, and treatments to combat citrus greening positions the company for significant growth in production and profitability over the coming years. Although the road to recovery is fraught with uncertainties, Alico’s ability to align its operational improvements with favorable market conditions could result in a substantial resurgence in its citrus operations.

4. Competitive advantages:

Alico’s competitive edge lies in its scale, land assets, and expertise. As Florida’s largest orange producer with a 17% market share, its size allows for better pricing, bulk purchasing discounts, and cost efficiencies. Its 53,371 acres of land, acquired at minimal cost, create high barriers to entry, as competitors would face steep land acquisition expenses. Additionally, Alico’s 125 years of experience in orange production provide it with unparalleled industry knowledge and strong relationships with buyers and suppliers. These advantages position Alico as a leader in Florida’s citrus industry, despite the challenges it faces.

5. Management:

Alico’s management, led by John Kiernan as President and CEO, demonstrates a strong commitment to maximizing shareholder returns. With extensive experience in investment banking, including roles as Managing Director at Bear Stearns and VP of Investor Relations for publicly traded companies, Kiernan brings deep expertise in capital allocation and corporate finance to the role.

Since joining Alico, he has strategically managed the company’s resources, overseeing opportunistic land sales, debt reduction, and share buybacks to enhance shareholder value. His belief in the citrus business is evident, but he remains pragmatic, prioritizing land monetization if it delivers greater returns.

Recent adjustments to executive compensation, such as tying bonuses to ROIC and share price performance (with targets exceeding $35–$50 per share), further align management’s interests with those of shareholders. Additionally, the inclusion of a Change of Control clause in the 2023 Proxy Statement suggests a readiness to consider a sale at a significant premium if it benefits investors.

Under Kiernan’s leadership, Alico is positioned to navigate its challenges while pursuing long-term growth and value creation.

6. Investment thesis:

Alico presents an attractive investment opportunity with a favorable risk-reward profile driven by its dual value drivers: strategic land monetization and a potential turnaround in orange production.

Bull Case: 2–3x Potential in 2 Years

Alico's upcoming sale of its Fort Myers County land, I expect it to be between 2025 and 2026, could generate $90–$135 million in gross proceeds at $20,000–$30,000 per acre or higher as this piece of land is prime real estate in one of the fastest growing counties in Florida. With management unlikely to aggressively pay down its attractively priced 4% debt, these proceeds could fund share repurchases or a special dividend, directly enhancing shareholder value.

Simultaneously, a successful turnaround in citrus production, bolstered by maturing trees and improving yields, could see Alico return to full production levels. If this happens, the company has the potential for a 2–3x valuation increase within the next two years, driven by higher revenues, improved profitability, and market recognition of its operational success.

Bear Case: Land Value Provides a Safety Net

Even in a pessimistic scenario where the citrus business fails to recover, Alico's land holdings provide a solid floor for valuation. With over 53,371 acres in one of the fastest-growing states, the company offers a hedge through its undervalued land assets, currently priced at a 50% discount to their fair market value. Management’s clear incentives, such as the Change of Control clause and alignment with shareholder interests, suggest a willingness to sell land or even the entire company to maximize returns.

While monetizing the land entirely may take 5–10 years, reducing the internal rate of return (IRR), the 2x potential from current prices in this scenario still outperforms market benchmarks.

Conclusion: Limited Downside, Significant Upside

Investors are presented with a low-risk, high-reward opportunity:

In the best case, Alico achieves a successful citrus turnaround and executes strategic land sales, delivering market-beating returns of 2–3x within two years.

In the worst case, the investment is backed by appreciating land assets, offering steady mid-single-digit growth and a 2x return over a longer horizon.

This dual-path potential—big profits if the turnaround succeeds and solid, market-beating returns even if it doesn’t—makes Alico a compelling and resilient investment.

7. Risks:

Alico’s investment thesis is backed by a strong margin of safety, with limited major risks. However, there are a few unlikely but possible challenges to consider:

Management Execution: While highly unlikely, poor decision-making or mismanagement could hinder the company’s ability to realize the full value of its assets. That said, management’s incentives are clearly aligned with shareholder interests, making this risk minimal.

Natural Disasters: The biggest risk to the citrus turnaround is another catastrophic event, such as a severe hurricane or freeze. Such an event could derail recovery efforts, reducing Alico to a land monetization and real estate play. While this would still provide a solid safety net for investors, it would limit the upside potential tied to the citrus business.

Extended Time Frame: If the company transitions entirely to a land monetization strategy, the timeline for unlocking value could stretch over 5–10 years. This delay would reduce the internal rate of return (IRR) for investors, particularly in the absence of additional catalysts.

8. Conclusion:

Alico presents a compelling investment opportunity with multiple catalysts poised to unlock significant value in the coming years. The potential for a successful turnaround in the orange business, combined with the high-value sale of the Fort Myers land, could drive substantial upside in the company’s share price. If either the citrus recovery or the land sale exceeds expectations, the market is likely to recognize Alico's intrinsic value.

Additional catalysts, such as a share repurchase program or a special dividend funded by land sale proceeds, further enhance the attractiveness of this investment. With limited downside risk, thanks to the underlying value of its land holdings, and substantial upside potential through operational and strategic actions, Alico offers investors a rare opportunity to achieve market-beating returns with a strong margin of safety.

Disclaimer:

The information provided in this article is for informational purposes only and should not be considered financial advice. The content does not constitute a recommendation to buy, sell, or hold any security or investment. Always do your own research and consult with a professional financial advisor before making any investment decisions. Investing in stocks involves risk, including the potential loss of principal. Past performance is not indicative of future results.

I have published an update on the company as they are transitioning into becoming a land developer.

https://smallcaptreasures.substack.com/p/alico-update-turning-citrus-groves?r=1od1d5

Great read and interesting play. I will deep further into the company, but this seems like an asymmetrical bet especially with the land. Thank for sharing!