A Deep Dive into PGM Miners: Spotlight on Anglo American $ANGPY, Sibanye $SBSW, Impala $IMPUY, Sylvania $SLP, and African Rainbow $ARI

Exploring cost structures, growth prospects, and key catalysts in the evolving platinum-group metals market.

As many of you may already know, I have a bullish thesis on PGM metals. I’m currently expressing this view by investing in Sylvania Platinum—one of the few companies that has remained profitable despite lower PGM prices—and by holding palladium and platinum through an ETF. Since I published my thesis, palladium has declined by 4% and platinum has remained flat, while Sylvania has risen by 13% and posted strong results.

Quick Summary of My Overall PGM Thesis:

Stronger-than-expected demand driven by new applications, especially as hybrid vehicles grow faster than BEVs.

Uncertain supply from South Africa and Russia, both prone to geopolitical tensions and trade disruptions.

Pressure on miners due to low prices, leading to canceled projects and mines being placed on care and maintenance.

If you want more detail, please refer to the full thesis I previously wrote.

Many of you have asked which miners I recommend for gaining exposure to PGMs. I typically suggest Sylvania, even though it’s not strictly a traditional miner, because it would likely suffer the least if low prices persisted for a longer period. However, since PGM prices appear to be bottoming, we can also look at other miners with higher production costs—those that offer greater leverage when prices recover.

As certain catalysts become more likely, it might be a good time to consider some riskier bets in the PGM space. Events such as the complete closure of one of the Stillwater mines, very poor production figures from Nornickel, or PGMs becoming subject to sanctions (especially in the context of potential trade conflicts with Russia) could be triggers. With substantial short interest in palladium, a short squeeze is possible under the right circumstances.

We will analyze each relevant company so that you have a clear understanding of how they might benefit from long-term PGM market trends. The three largest players in the PGM market—Anglo American Platinum, Sibanye Stillwater, and Impala Platinum—share similar industry-related threats. Their main differences lie in valuations and cost structures, which affect their leverage to PGM prices. Most of their operations are located in South Africa, which carries its own risks since it’s a BRICS country and could face tariffs or other trade barriers.

In addition, we’ll look at some smaller but interesting players, such as African Rainbow, my favorite Sylvania, and if this article is well received, I will analyze various mining projects. By the end of this article, you should have a solid understanding of the different ways to invest in the PGM market.

Impala platinum

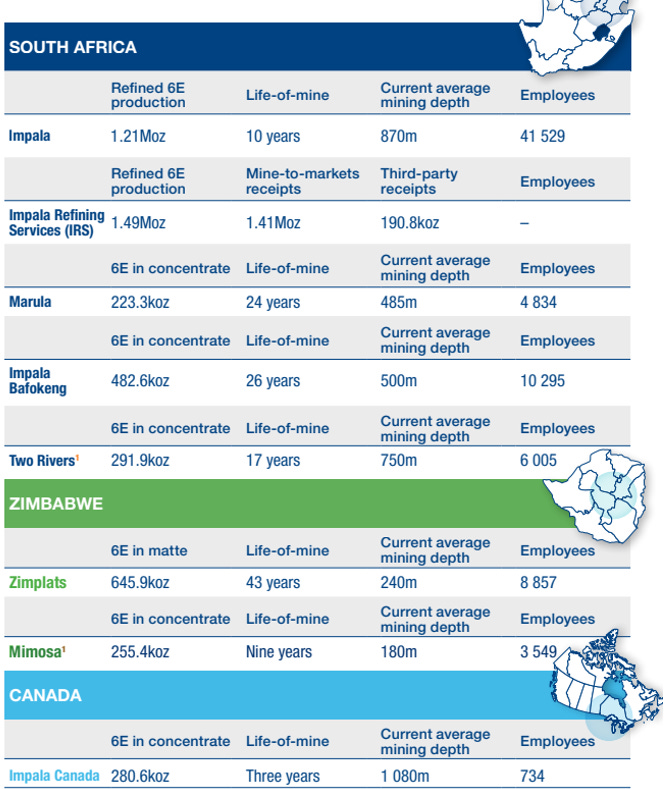

Impala Platinum is a major player in the PGM market, with a market cap of around $5 billion and significant exposure to PGMs. The company operates mines in South Africa, Zimbabwe, and Canada, contributing roughly 20% of global PGM supply, with total attributable resources of 316.5 million ounces. One of my main concerns about Impala, however, is the limited remaining life of its primary mines.

The company currently produces 3.38 million ounces of PGMs annually. Yet, over the next decade, mines responsible for 1.745 million ounces of annual production are expected to reach the end of their life, potentially cutting overall output by more than half.

Impala is increasing production, but costs have risen due to the inflation challenge many miners face. These costs may stabilize over time, but it remains a concern.

CAPEX and Production

Impala’s capital expenditures (CAPEX) have dropped significantly, particularly for expansion, but it’s unclear how they reported a -114% reduction in expansion investment—it may be a data error. Most of the company’s production growth comes from a tenfold increase at Impala Bafokeng, which offsets declines at other mines. Nevertheless, revenue has fallen with lower PGM prices. Although Impala’s cash position is at a multi-year low, the company remains cash-positive after accounting for debt.

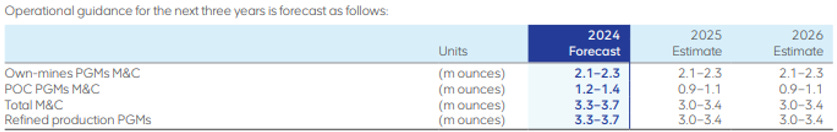

Looking ahead, management projects refined production of 3.45 to 3.65 million ounces (a 2–8% year-over-year increase), with costs growing by 0–5% and a significant CAPEX reduction from $800 million this year to $440–495 million next year. However, much of that CAPEX is merely to maintain production and comply with regulations. With only one true growth project, it’s unclear whether the company can offset the declines at mines approaching their end of life.

Costs and Profitability

Impala (primary mine): Cash costs are about $1,161 per 6E ounce. Due to large depreciation and amortization (D&A) tied to previous CAPEX, this mine is barely profitable at current PGM prices.

Zimplats (second-largest mine): Cash costs average $829 per ounce, which is relatively low. However, high CAPEX needs mean the operation is not yet free-cash-flow positive.

Other operations: Cash costs hover around $1,000–$1,100 per ounce, and extensive CAPEX has kept them cash-flow negative. Production growth this year has come only from the Impala Bafokeng acquisition; other mines have struggled to maintain output despite sizable investments.

The Two Rivers mine is currently receiving most of the company’s growth CAPEX. Although it has low cash costs for now, it’s set to enter care and maintenance in Q1 of this year, meaning further development depends on higher PGM prices.

Metal Exposure

Impala has notably high exposure to palladium and rhodium—about 20–30% of total production comes from each of these metals, which is much higher than many competitors.

Valuation

At a $5 billion market cap, Impala may appear inexpensive, especially if PGM prices rebound to 2021–2022 levels. In that scenario, the company could generate $1.5–$2.5 billion in free cash flow, given that palladium and rhodium have dropped roughly 80% from their peak. However, high CAPEX requirements just to maintain production and significant goodwill impairments raise questions about whether Impala can compensate for the declining output at its core mines. If PGM prices don’t find a bottom, the company might need to take on debt or close additional mines.

That said, if you believe PGM prices are poised for a sharp rebound, Impala could be an interesting play. It holds a large reserve of around half a million ounces that could be sold at higher prices, and a market upswing would push most mines back above breakeven. With considerable exposure to heavily shorted palladium and rhodium, a short squeeze could drive prices high enough for Impala to surpass $2 billion in FCF, sending the share price to $10–$15—a potential 2–3x return within a couple of years.

Overall, I find the risk-reward profile less than appealing. Management has diluted shareholders in the past while paying dividends—an unfavorable approach when trading at under 10x EBITDA. In my opinion, there are better risk-reward opportunities to capitalize on the current PGM cycle.

Anglo American Platinum

Anglo American Platinum (Amplats) is the largest PGM miner by market share. Its share price has fallen significantly—from over $150 in early 2022 to the mid-$30 range now. Let’s consider whether this drop might present a compelling opportunity or if there are better risk-adjusted plays in the sector.

The first major consideration is Anglo American’s majority ownership of over 60%. Over the past few years, Anglo American has divested several “non-core” assets—such as coal assets sold to Peabody—and has now confirmed a demerger of Anglo American Platinum as well. The demerger is expected to be completed by mid-2025. Some new shares have already been issued to increase the free float, though this might not be the ideal time to issue shares given the lack of investor enthusiasm for PGMs. Further share sales are not planned until the company is listed on the London Stock Exchange (LSE); once listed, Anglo American will face a 90-day lockup period before it can sell more shares.

Anglo American Platinum’s strong suit is its low unit costs, which hover around $1,000 per ounce and are projected to decrease further. In fact, it was the only pure PGM miner to post a profit in the first half of 2024, highlighting its operational efficiency. The company forecasts total PGM production of 3.5 million ounces in 2024, followed by a 10% decline in 2025 and 2026, averaging around 3.2 million ounces for both managed and consolidated operations. Still, it plans to keep its own mine production at 2.1–2.3 million ounces per year.

In the first half of the year, attributable PGM production stood at about 1 billion ounces (with additional supply sourced from joint ventures and third parties). Its average All-In Sustaining Cost (AISC) for 3E ounces was $957, suggesting profitability even if current low PGM prices persist.

Regarding metal exposure, about 46% of Amplats’ PGM production comes from platinum, around 33% from palladium, and the remainder from other PGMs plus a bit of gold. This mix offers solid palladium exposure relative to some peers.

Overall, Anglo American Platinum appears inexpensive but trades at a slight premium compared to competitors like Impala, likely due to its market leadership and lower-cost operations. The pending demerger adds uncertainty, making it less attractive in the short term, but its low production costs give it a cushion against depressed PGM prices. Personally, I would wait until its London listing to gain more insight into Anglo American’s plans after the 90-day lockup period.

Without considering the demerger, Amplats could be the safest miner in the PGM space due to its resilience, scale, and operational advantages. However, the demerger process—and how Anglo American handles it—remains a key factor in evaluating the company’s risk-reward profile.

Silbanye Stillwater

Sibanye Stillwater, often highlighted on Substack, trades on the NYSE and is therefore more accessible to U.S. investors. Over the past decade, the company has outperformed many of its peers. However, it’s also quite complex to value due to its diverse operations:

Gold Mining: Expected to produce over half a million ounces of gold this year.

PGM Mining: Active in both South Africa and the U.S., with a significant portion of PGM production coming from recycling.

Lithium Assets: Owns what is claimed to be the largest lithium mine in Europe, plus a battery recycling plant.

Byproducts and Other Minerals:

Chrome byproduct from PGM mining.

Around 60 million pounds of uranium in tailings; recently entered a joint venture for the Beisa uranium project. Sibanye will receive a cash payment, 40% equity in Neo Energy, and royalties of up to $5/lb of uranium—potentially significant if prices rise.

DRD Gold Stake: Holds 50% of DRD Gold, which has a market cap of nearly $1 billion, valuing Sibanye’s stake at around $490 million.

Streaming Deal: Raised $500 million from Franco-Nevada by pre-selling gold and PGMs from South African operations.

At current PGM prices, Sibanye’s PGM operations are under pressure. U.S. production costs stand at around $1,400 per ounce, while South African costs are somewhat lower, but still significantly higher than those of competitors like Impala and Anglo American. In response, the company has placed the Stillwater West Mine on care and maintenance and reduced its workforce to lower costs until prices recover.

Despite having some debt, Sibanye is unlikely to struggle with servicing it. Overall, Sibanye’s complexity makes it intriguing. Its gold mining business alone could justify much of its market cap, and the additional uranium JV, DRD stake, lithium and battery recycling operations, and PGM assets suggest multiple growth levers. The market’s main concern seems to be the weak PGM segment; with an enterprise value of around $3.5 billion and historical net earnings above $2 billion at peak prices, the stock appears cheap but remains vulnerable to further declines in PGM prices.

In the short term, Sibanye could be hit hardest if PGM prices continue to fall. However, over the long term, its diversified asset base may offer a more attractive story—potentially making it an asymmetric bet for investors comfortable with the risk. Given its complexity, a standalone, in-depth analysis of Sibanye Stillwater might be warranted.

African rainbow

African Rainbow is a smaller mining company with some of the lowest cash costs in the industry—second only to Sylvania. Its exposure to PGMs is below 40%, which helps it remain profitable and pay a dividend yield of around 10% at these market conditions.

Diversified Commodity Exposure

African Rainbow has interests in:

PGMs (including a shared ownership in the Two Rivers mine with Impala)

Ferrous Metals

Coal (it owns stakes in two open-pit mechanized coal mines)

Gold (with an 11.8% stake in Harmony Gold, worth $885 million at Harmony’s current market cap of $7.5 billion)

Notably, the Harmony Gold stake alone represents roughly half of African Rainbow’s market cap, which underscores the value of this holding. Iron ore and PGMs generate most of African Rainbow’s profits; however, PGM profits were nearly zero last year. Despite reduced PGM exposure, the segment is still critical to the company’s future—current low prices have forced the company to put 50% of its Two Rivers PGM production on care and maintenance (cash costs at Two Rivers are around $920 per ounce).

Even though PGM production at Two Rivers is expected to drop by 50% next year, the company anticipates overall growth in 6E PGM production over time, potentially rebounding as prices recover.

Its broader commodity exposure—iron ore, coal, and gold—provides diversified cash flow and mitigates the downside risk typically associated with volatile PGM markets. However, iron ore and thermal coal prices have also been declining since their 2020–2021 highs.

Iron ore prices are similar to thermal coal prices or PGM prices they have been in an steady decline after the 2020-2021 boom in prices.

Valuation

African Rainbow’s enterprise value (EV) is around $1.5 billion, and its stake in Harmony Gold is worth about $885 million. Subtracting this stake from the EV implies that the rest of the company is being valued at only $600 million. For this price, investors get:

Potential PGM production capacity of around 600,000 ounces (with low cash costs)

Iron ore and thermal coal operations that could perform well once prices stabilize

The company currently pays a sustainable 10% dividend, even at what appears to be the low point in the commodity cycle. In a recovery scenario—if thermal coal and PGM prices revert to mid-cycle levels—African Rainbow could potentially return to $300–$500 million in annual free cash flow, suggesting that the core business could be worth $2–$3 billion. Adding the Harmony Gold stake points to a clear possibility of the stock doubling, with further upside and limited downside.

Although African Rainbow doesn’t have as high PGM exposure as some other miners, it offers compelling long-term prospects, relatively low downside risk, and a substantial dividend yield. Given its strong fundamentals and discounted valuation, it appears well worth a deeper look, especially for investors seeking exposure to multiple commodities with a lower-risk profile.

Sylvania Platinum

Sylvania Platinum is distinguished by its low-cost tailings-reprocessing model, which keeps it profitable even when PGM prices decline. The company’s strong balance sheet—holding over $100 million in cash and carrying no debt—enhances its financial security and allows for dividends, share buybacks, and ongoing reinvestment.

Management has committed to returning at least 40% of adjusted free cash flow to shareholders. Any future upswing in PGM prices could significantly boost both EBITDA and the stock’s valuation. Sylvania’s growth programs are designed to capitalize on higher prices with increased production, all supported by its low-cost operating model. As a result, the company is conducting buybacks and paying an attractive dividend.

With cash amounting to over half its market capitalization, Sylvania appears well-positioned to weather prolonged low PGM prices while still rewarding shareholders. For a deeper exploration of my investment thesis on the company, you can refer to my detailed write-up.

Conclusion.

In conclusion, if I had to choose one among the top three major PGM miners (Impala, Anglo American, and Sibanye Stillwater), I would pick Sibanye for its high leverage to PGM prices. Although Impala and Anglo American are both strong companies offering decent exposure, they provide a less attractive risk-adjusted return compared to simply holding the underlying metals. Sibanye, by contrast, offers significant short-term upside in PGM prices and a margin of safety in the long term due to its diverse asset base.

I also want to highlight African Rainbow, which appears remarkably undervalued. It gives investors relatively cheap PGM exposure alongside thermal coal and iron ore “for free,” with exceptionally low production costs—even though PGMs are not its main revenue source. In my view, it’s an intriguing miner that deserves a closer look.

Lastly, I must reiterate my preference for Sylvania Platinum, which I believe is the top play in the PGM market. I hope this overview has provided a useful introduction to the sector. If you found this content valuable, consider upgrading from a free subscription to a paid one, as I’ll be publishing more in-depth reviews of these and other mining companies exclusively for paid subscribers. Don’t forget to like and share!

Disclaimer:

The information provided in this article is for informational purposes only and should not be considered financial advice. The content does not constitute a recommendation to buy, sell, or hold any security or investment. Always do your own research and consult with a professional financial advisor before making any investment decisions. Investing in stocks involves risk, including the potential loss of principal. Past performance is not indicative of future results.

Sylvana Plat has a huge issue, namely liquidity. This things trades so rarely and with an obscene spread that i opted to close my position just days ago for a 1 % gain. I think it has great economics, but its just not liquid enough, at all.

For that reason, my favorite henceworth is Sibanye.

That said, thanks for the great overview.

Great overview, thanks for highlighting African Rainbow I am going to take a deeper look at that one