Palladium and Platinum: The Dawn of a New Market Era?

Positioning for Growth: Palladium’s Role in a Slower-than-Expected EV Transition

Investment Report

Key points:

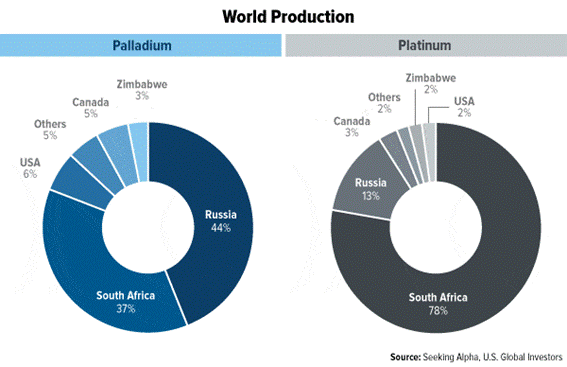

Palladium and Platinum Supply Risks: Both metals face significant supply risks, with production heavily concentrated in Russia and South Africa. Geopolitical tensions, operational disruptions, and shrinking reserves could tighten the market and drive prices higher.

Delayed EV Transition: The anticipated rapid shift to electric vehicles (EVs) has been slower than expected, with internal combustion engine (ICE) and hybrid vehicles still dominating. This supports continued demand for palladium and platinum in catalytic converters.

Potential Short Squeeze in Palladium: Short interest in palladium has dropped by nearly half since its peak, contributing to a 30% price rise. If supply disruptions or stronger demand emerge, a short squeeze could send prices soaring.

Investment Opportunities: Investors can capitalize on these dynamics through ETFs, long-term physical holdings, or selectively investing in mining stocks. With structural supply deficits and potential price recovery, palladium and platinum present compelling opportunities.

1. Introduction:

Palladium, part of the platinum group metals (PGMs), is a crucial element, primarily used in catalytic converters for vehicles. These converters play a vital role in reducing harmful emissions, helping the automotive industry meet strict environmental standards. In recent years, however, the palladium market has suffered a significant decline, largely driven by expectations of future surpluses. Since its peak in 2022, palladium prices have plummeted as investors bet on an oversupplied market.

In my view, the market is overreacting. The short thesis surrounding palladium, which we’ll dive into later, is starting to unravel, and some savvy investors are beginning to take notice. I believe this is just the beginning. The overwhelming evidence points to strong upside potential for palladium and other PGMs, and soon, the market will have no choice but to respond.

In this article, we’ll explore palladium’s market structure, key suppliers, the dynamics behind short interest, the implications of the electric vehicle (EV) transition, and strategic investment opportunities. We’ll also examine the recycling market and the current state of above-ground stocks.

2. Key suppliers and global supply chain risks:

Palladium and platinum production is heavily concentrated in Russia and South Africa. Russia, particularly through Norilsk Nickel (Nornickel), is the largest producer of palladium, while South Africa dominates in platinum production. Together, these two countries account for the majority of global supply, making any disruptions in their mining sectors critical for market stability.

Russia

Russia's palladium supply is heavily influenced by geopolitical factors, and the situation is precarious. Russian mining operations rely on high-tech equipment from the US and Europe, which makes them vulnerable to any potential embargo on these essential components. A full technology embargo could seriously cripple Russian palladium production.

While Nornickel remains profitable, this is largely due to government subsidies, which keep the operation afloat. Interestingly, palladium and platinum exports from Russia have so far avoided major tariffs, as these metals are vital to the automotive sectors in both the US and Europe. However, given the deteriorating relationship between Russia and the West, the imposition of tariffs cannot be ruled out in the future.

Having half of the world’s palladium production concentrated in Russia also makes the global supply highly vulnerable to black swan events—be it a natural disaster like a flood or tornado, or unforeseen geopolitical disruptions.

In addition, Russia appears to be using palladium sales to finance its ongoing war efforts. Recent evidence of Russia’s central bank purchasing large quantities of precious metals, including palladium and platinum, suggests that the country may have already depleted a significant portion of its reserves to fund the war.

South Africa

South Africa’s mining sector faces its own challenges, including frequent power outages, labor strikes, and corruption. These issues have led to production cuts, adding strain to the global supply of PGMs. Producers such as Anglo American Platinum and Sibanye Stillwater have already scaled back their expansion projects, and there are fears that further operational setbacks could exacerbate supply shortages.

Sibanye Stillwater, one of the leading platinum producers, has faced significant operational disruptions, including regulatory fines and large-scale layoffs. Another major producer, Impala Platinum, is also nearing the end of its primary mining life, with its largest mine set to close in 2031.

Most miners are operating at a loss and if we do not see some upside on palladium and platinum prices supply will continue to suffer.

Recycling

Much of the market's expectations for palladium supply growth is based on recycling. As diesel vehicles, which use palladium in their catalytic converters, reach the end of their life cycle, palladium recycling is projected to grow at a compound annual growth rate (CAGR) of 9%. However, any delays in this trend materializing could lead to a significant price surge.

Several factors are already pushing this timeline back. Higher interest rates, combined with the rise of remote work, are encouraging people to hold on to their old vehicles longer than expected. Additionally, around 10% of palladium recycling is suspected to be conducted by illegal operations, which are now under increased scrutiny by the FBI. Several US states have implemented strict regulations to combat this criminal activity, but these laws are so stringent that they may inadvertently reduce legal recycling efforts as well.

3. Short interest and the potential for a short squeeze:

Short interest in palladium peaked on August 6th, with traders betting on a surplus in supply and falling demand. However, short positions have nearly halved since that peak, leading to a 30% rise in palladium prices as traders rushed to close their positions. If supply disruptions from Russia or South Africa materialize, or if demand for palladium strengthens, there could be a substantial short squeeze, driving prices significantly higher.

Wall Street's primary concern is the rise in recycled palladium. Recycling palladium is not highly profitable unless prices are elevated, and mining remains a challenging business at current prices. As palladium prices rise, however, the incentive to recycle grows, potentially putting downward pressure on prices in the future. For now, the market appears to be bouncing back into a bullish trend.

4. ICE to EV transition: a slower reality:

The narrative surrounding the rise of electric vehicles (EVs) has been a key factor in the recent decline in palladium prices. Since EVs do not require palladium for catalytic converters, investors had forecasted a shift away from PGMs. However, recent data suggest that this transition may not happen as quickly as expected.

In developing countries, the adoption of EVs is slower due to infrastructural challenges, while in the US and Europe, recent surveys and sales data suggest that consumers still prefer gasoline or hybrid vehicles. A Deloitte survey found that 88% of US car buyers prefer fossil fuel-powered or hybrid vehicles, which still require palladium and platinum in catalytic converters.

Moreover, recent data indicates that sales of EVs have slowed considerably. In the first half of 2024, Volkswagen's EV sales in the US were down 28%, while Volvo's sales fell 72%. Even companies like Ford, which saw a rise in EV sales, reported significant losses of $2.5 billion on their EV division. Similarly, in Europe, EV sales fell 44.3% in August 2024. This suggests that internal combustion engine (ICE) and hybrid vehicles will continue to dominate the market for longer than expected, supporting demand for palladium and platinum.

5. Palladium surpluses into the future:

Both palladium and platinum have seen significant price declines in recent years. Since their respective peaks, palladium has dropped by 66%, while platinum has fallen by 25%. These declines are largely due to negative sentiment surrounding the transition from internal combustion engine (ICE) vehicles to electric vehicles (EVs). However, as noted earlier, the shift to EVs may not happen as quickly as expected, and demand for palladium and platinum in catalytic converters remains strong.

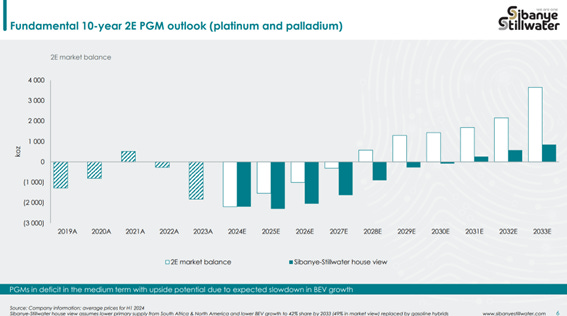

The forecasted structural deficits in palladium and platinum supply further support the potential for a price recovery. Palladium production has already decreased by 10% since its peak in 2019, and many producers are struggling to remain profitable at current price levels. If prices do not rebound soon, the industry risks seeing bankruptcies, which would further reduce supply and set the stage for a bull market.

The market had initially expected a surplus in platinum until 2026, but this outlook is now shifting. We could see supply deficits well into 2027, and with above-ground reserves covering less than six months of demand, the situation is tightening. Additionally, investors are beginning to see palladium and platinum as valuable resources, which could drive prices higher. Sibanye Stillwater has projected market deficits until 2030, and while their outlook may be somewhat biased, it’s becoming increasingly clear that we are unlikely to see surpluses in the palladium market anytime soon.

6. Investment strategies:

Investors looking to capitalize on the current dynamics in the palladium and platinum markets may want to explore the following strategies:

ETFs: Investing in physical palladium or platinum ETFs offers a relatively low-risk way to gain exposure to these metals as supply deficits grow. These funds allow investors to participate in the price appreciation of the metals without the operational risks that come with mining companies. Personally, I would consider SPPP, as it provides a balanced 50/50 exposure to both palladium and platinum, making it a solid choice for those wanting to hedge their bets on both metals.

Mining Stocks: Companies such as Sibanye Stillwater and Anglo American Platinum offer leveraged exposure to rising palladium and platinum prices. However, these stocks come with greater risks, especially given the operational challenges in Russia and South Africa. At the moment, I would avoid these companies, particularly since Anglo American is rumored to be considering divesting its stake in Anglo American Platinum, and Sibanye Stillwater faces significant risks beyond just palladium price recovery.

Long-Term Physical Holdings: For investors with a longer-term horizon, holding physical platinum or palladium could be a strategic play. As supply deficits widen and prices begin to rebound, physical holdings could provide strong returns, especially in a market facing structural shortages.

7. Conclusion:

Palladium and platinum markets are at a turning point. While recent years have been clouded by concerns over the rise of electric vehicles and an increase in recycling, the reality on the ground is starting to tell a different story. The shift to electric vehicles isn’t happening as quickly as many predicted, and traditional internal combustion and hybrid vehicles—both of which still need palladium and platinum—are sticking around longer than expected.

On top of that, supply risks from key producers like Russia and South Africa are real, and we’re already seeing production cuts. With reserves shrinking and geopolitical tensions rising, the supply-demand balance could tighten, leading to a rebound in prices.

For investors, this could be a great opportunity. Whether through ETFs, physical holdings, or carefully selected mining stocks, the potential for upside is growing. As the market starts to wake up to these realities, those who move early could benefit from what may be a strong rally in palladium and platinum. The facts are stacking up in favor of these metals, and it’s worth considering how to position yourself to take advantage of it.

Great write up as usual Hugo!

You focus on EVs, but made no mention of Hydrogen power, which is the only answer to bridging the gap to achieving net-zero carbon emission targets by 2050. Most of the world is backing the development of hydrogen power and investment is ramping up, see: https://rockandturner.substack.com/p/hydrogen-the-new-oil

Why is this relevant to your article?

It's all about chemistry. To produce hydrogen energy we need catalyzers in the electrolysis process. Platinum is a catalyzer and, being a rare commodity, will inevitably appreciate in value as demand from electrolyzer manufacturers ramps up.

If you want exposure to platinum-group metals (PGMs), including Platinum and Palladium, but also Rhodium, Iridium and others, I highly recommend Sylvania Platinum (SLP), listed in London. It is a market leading platinum group metals miner.

The valuation is currently very attractive because of a number of issues that were entirely beyond the control of the very well managed company.

One such issue is the power utility failures across the region of South Africa in which the mines are located - something being dealt with through improved power infrastructure, but Sylvania are also now using their own generators for when the power grid fails.

Another issue relates to the cyclicality of the commodity markets. Platinum group metals are currently trading well below peak levels due to geo-political issues which will resolve in due course.

The great part about market downturns are that they tend to flush out the operators with poor balance sheets and low levels of efficiency. It is like the commercial version of Darwin's survival of the fittest. As we emerge from the PGM winter, the stronger players will emerge with greater market share. Sylvania Platinum is one such company, trading at a fraction of its forward discounted cash flow valuation (disclosure: I have a position in Sylvania Platinum).

Food for thought.