Part 2 – PGMs in the Spotlight: Platinum’s Path Amid Geopolitical Uncertainty

The key is when it will happen not if it will happen

Investment Report

Key points:

Platinum’s demand is more evenly balanced than palladium’s, making it less volatile as only 40% of its use comes from catalytic converters (vs. 80% for palladium).

The emerging hydrogen economy could significantly increase platinum’s long-term demand, as it’s a key catalyst in producing clean hydrogen fuel.

Geopolitical tensions, especially concerning Russia, introduce short-term volatility. Possible tariffs or their removal can swing prices, though the long-term thesis remains intact.

Persistent supply deficits in platinum are expected to continue until at least 2028, which, combined with limited new mine development, sets the stage for a strong price rebound.

1. Introduction:

Platinum and palladium have emerged as two of my top choices for market exposure over the next two years. These precious metals aren’t just shiny assets; they hold significant value due to their unique industrial applications and potential to benefit from the global push toward cleaner energy and sustainable technologies. In my previous article, I focused more heavily on palladium, emphasizing its greater upside potential—albeit with higher risk. By comparison, platinum offers a more stable investment proposition, especially as a critical component in the energy transition.

If you haven’t already, I encourage you to read the first part of my thesis on Platinum Group Metals (PGMs). There, I covered the most important fundamentals driving these markets.

Today, I’ll build on that foundation with new insights, paying particular attention to platinum. At Twelve and Eight Capital, we currently allocate about 15% of our portfolio to this sector, reflecting our conviction in the strong recovery that we anticipate over the coming years. In a subsequent article, I will detail the specific companies we’re investing in, as well as discuss a strategic hedge to mitigate risks stemming from the ongoing situation with Russia. In short, I believe that both platinum and palladium are well-positioned to reward patient investors in the coming years.

2. Platinum:

Nearly thirty times rarer than gold, platinum possesses a unique set of characteristics—extreme durability, high malleability, and strong resistance to corrosion—that have established it as a critical material across multiple industries. While its largest single application remains the production of catalytic converters for internal combustion engines, this end-use constitutes roughly 40% of annual demand, making platinum less sensitive to shifts in automotive technology than palladium, where catalytic converters account for around 80% of demand. As a result, platinum’s price dynamics tend to be more stable and less prone to the extreme volatility that characterizes palladium markets.

Beyond the automotive sector, platinum’s value is supported by its broad range of industrial and investment uses. It is widely employed in the jewelry industry due to its durability and luster, and it has a well-established role as an investment asset, historically serving as a hedge against inflation. Moreover, platinum’s potential extends into emerging clean-energy technologies. Its catalytic properties make it an integral component in hydrogen fuel cells—a key technology in the green energy transition. This growing use case provides a long-term tailwind, as governments and corporations invest heavily in renewable energy infrastructure and seek sustainable alternatives to traditional fossil-fuel-powered transportation.

In other words, while platinum may not offer the same immediate leverage to trends in automotive emission standards as palladium, it compensates by providing a more balanced and resilient portfolio of end-uses. Its combination of established industrial demand, nascent growth opportunities in hydrogen technology, and role as a reliable store of value makes platinum a compelling investment that can weather market uncertainties while still capturing upside potential from the ongoing energy transition.

3. Hydrogen revolution:

As the global community intensifies its efforts to combat climate change, hydrogen has emerged as a cornerstone solution in the race toward net-zero carbon emissions by 2050. Unlike fossil fuels, hydrogen—when produced using renewable energy—emits virtually no greenhouse gases, making it a pivotal player in the clean-energy landscape. Governments around the world are increasingly recognizing hydrogen’s potential, dedicating vast subsidies and policy support to scale up production, distribution, and storage infrastructure. This financial backing, combined with advances in technology, is laying the groundwork for a sweeping hydrogen revolution that could reshape the global energy mix.

At the heart of this transformation lies the process of electrolysis, which uses electricity to split water molecules into hydrogen and oxygen. To achieve this at scale and efficiency, high-performance catalysts are needed. Platinum is one such catalyst, prized for its ability to accelerate chemical reactions and improve the overall efficiency of hydrogen production. As demand for electrolyzers grows and more hydrogen projects come online, platinum’s scarcity and essential function will likely drive its value higher. This dynamic creates an attractive investment narrative: not only does platinum stand to benefit from a broad-based shift away from carbon-intensive fuels, but its fundamental role in hydrogen production ensures it will remain a key input in the clean-energy economy for decades to come.

While hydrogen technology has been somewhat disappointing over the last few years, it remains a strong long-term trend that has not yet been fully reflected in PGM prices. Platinum’s robust use cases in this sector make it a safer bet than palladium.

4. Platinum deficits:

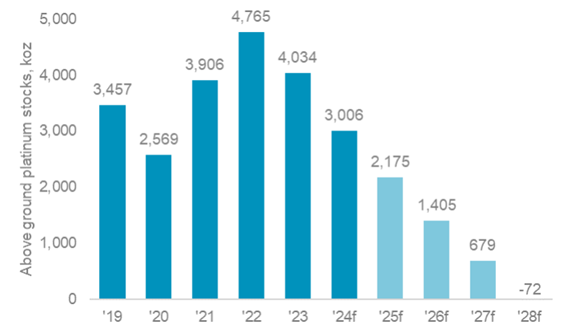

In contrast to palladium, where massive surpluses were once projected after 2027, platinum’s outlook is increasingly characterized by persistent supply shortfalls. Recent forecasts from the Platinum Investment Council project ongoing deficits of over 700,000 ounces through 2028, and these figures continue to be revised upward as time goes on. Several factors are driving this tightening market.

First, platinum’s appeal as an investment asset has grown significantly. Physical bars and coins are gaining popularity as an accessible form of private investment, evidenced by retailers like Costco now selling one-ounce platinum bars directly to consumers. This surge in investor interest reduces the amount of platinum available for industrial buyers.

Second, a downward trend in recycling—historically an important source of secondary platinum supply—has constrained the flow of recycled metal back into the market. Combined with a steady expansion in industrial uses, these supply-side challenges further widen the gap between production and demand.

It’s also worth noting that these forecasts do not fully account for the potential boom in hydrogen-based technologies, which rely on platinum as a catalyst for efficient hydrogen production. As hydrogen infrastructure scales up, platinum demand could accelerate well beyond current expectations, deepening the supply deficit. In short, all signs point to a platinum market that is becoming increasingly undersupplied, a condition likely to support higher prices over the next several years.

5. US VS Rusia:

Geopolitical tensions between the United States and Russia have long influenced global commodities, and Platinum Group Metals (PGMs) are no exception. Russia’s significant output of palladium and platinum plays a critical role in global supply chains, making these markets sensitive to any potential policy shifts or sanctions. About a month and a half ago, the United States suggested the possibility of G7-imposed tariffs on Russian palladium exports. This move sparked a short-lived rally in palladium and platinum prices as traders anticipated restricted supplies.

However, in the ensuing weeks, the market cooled down. Prices fell back to levels even lower than before the tariff announcement, largely due to growing skepticism that such measures would actually materialize—especially if a U.S. administration less inclined toward direct trade restrictions comes into power. A Trump victory, for instance, might be seen as making these tariffs less likely, reducing the immediate geopolitical risk premium in the palladium and platinum markets.

The broader takeaway is that PGM prices can swing significantly in response to political rhetoric and policy uncertainty. For investors, it’s important to remain aware of these geopolitical undercurrents, as any escalation in trade tensions or implementation of sanctions can quickly alter supply dynamics, impact market sentiment, and consequently influence metal prices.

6. Catalyst:

In the near term, geopolitical developments—particularly tensions between the United States and Russia—stand as powerful catalysts for price volatility in the palladium and platinum markets. The war in Ukraine has already added complexity to global supply chains, and any policy shifts, such as the imposition of tariffs on Russian PGM exports, could send shockwaves through the market. While potential changes in U.S. leadership might influence the direction of these policies, the uncertainty itself can create short-term spikes or dips in prices.

Over the longer horizon, fundamental supply and demand imbalances are set to play a more decisive role in shaping market conditions. Current low prices fail to incentivize new mine development, with some operations going into care and maintenance mode as producers struggle to remain profitable. As above-ground stockpiles dwindle and existing production is insufficient to meet rising demand—driven in part by expanding use cases in the hydrogen sector—these deficits could deepen year after year.

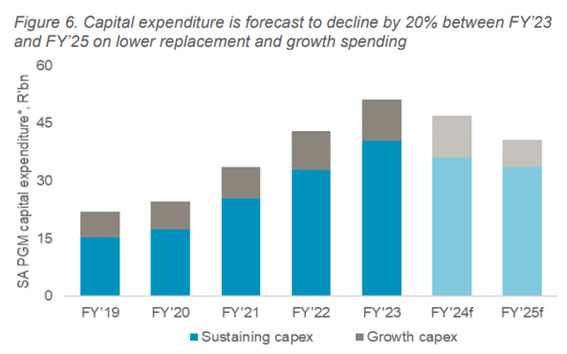

Adding to this tension, capital expenditures in the industry are projected to decline by around 20% from 2023 levels. Compounded by antitrust laws that prevent synchronized production cuts, producers are often forced to continue selling into the market at marginal returns. This slow bleed reduces future productive capacity, eventually culminating in a significant supply squeeze. When the market finally acknowledges that new mines can’t be brought online quickly—given that it can take up to two decades to establish a functioning PGM mine—the realization could lead to an abrupt surge in prices.

In essence, while short-term geopolitical events may trigger sudden price moves, the underlying catalysts—long-term supply constraints, limited new project development, and robust demand growth—are likely to prove even more influential. Once the structural realities become too glaring to ignore, the potential for a dramatic upward price revision becomes increasingly likely.

7. Hedge against Russia:

The ever-present uncertainty in the Russia-Ukraine conflict has a direct bearing on the PGM markets. If the war were to end sooner than anticipated and no tariffs on Russian PGM exports materialize, this scenario could lead to short-term stagnation or even a decline in platinum and palladium prices. For investors heavily positioned in PGMs, such an outcome would be less favorable.

To counter this possibility, one interesting hedge could be investing in a company like Olvi (OLVAS). Olvi, through its Belarusian subsidiary, has faced significant operational challenges due to geopolitical tensions, suffering a 50% drop in share price. However, if the conflict in Ukraine reaches a resolution and economic conditions normalize, Olvi could regain access to its Belarusian operations, continue running them profitably, or potentially sell the subsidiary at a substantial valuation uplift.

In short, should the end of the conflict mitigate pressures on Russian exports and temper PGM prices, Olvi could provide a complementary upside. The company’s share price might jump as it resumes normal operations or capitalizes on a more stable geopolitical landscape. Thus, pairing a PGM investment with a stake in Olvi creates a scenario where, regardless of how the Russian situation unfolds, there’s a pathway to positive returns—if PGM prices rise, the initial thesis holds; if the Russia-Ukraine situation stabilizes and prevents tariff-related spikes, Olvi could deliver compensatory gains.

I will share the link to my friend David thesis on the company:

8. Conclusion:

I hold a strong conviction that this thesis will ultimately prove rewarding for investors who position themselves strategically. While not every company in the sector will benefit, those who purchase physical platinum at spot prices and invest in low-cost producers are set to gain from the market’s current challenges. As prices remain depressed, industry-wide layoffs and production cuts will likely tighten future supply, setting the stage for a potentially significant price rebound.

In the coming weeks, I will share a detailed analysis of the most promising company in this space, guiding you on how best to capitalize on this opportunity. With thoughtful positioning and patience, investors can stand to profit handsomely as the platinum market’s long-term dynamics play out.

Disclaimer:

The information provided in this article is for informational purposes only and should not be considered financial advice. The content does not constitute a recommendation to buy, sell, or hold any security or investment. Always do your own research and consult with a professional financial advisor before making any investment decisions. Investing in stocks involves risk, including the potential loss of principal. Past performance is not indicative of future results.

Great write up Hugo.

It is worth looking at Sylvania Platinum Limited (London: SLP) primarily engaged in the extraction of platinum group metals (PGM) in South Africa and Mauritius. PGMs are platinum, palladium, and rhodium.

This is a primary player in Platinum extraction and it has been very over sold. As such, it offers a very interesting entry opportunity with a favourable asymmetric skew.

On the depressed share price the dividend yield is double digits. The company has also been buying back its shares, reducing the share count by 12% over the last 8 years.

The market cap is £107m GBP, but it has a net cash position of $98m GBP - so the business is incredibly underpriced.

The net asset value of the company is £225m GBP, so there is a huge margin of safety here. It is what Ben Graham would call a net/net.

Sylvania Platinum has faced several significant headwinds that have impacted its performance. One of the primary challenges is the decline in the platinum group metals (PGM) basket price, which has dropped by around 36% in the average PGM prices, significantly affecting the company's revenue and net profit. Commodity prices are cyclical and we seem to be emerging from the low of the cycle now.

Additionally, the company has encountered operational disruptions, including a 22-day strike in the fourth quarter of 2024, which resulted in 10% lower production and increased operating costs by 5.6%. Those strikes are now over. Other challenges have included operational difficulties such as power disruptions due to poor local infrastructure - but the company has now invested in generators to mitigate this risk.

All of these challenges have been exogenous - none affect the viability of the business nor do they undermine its unit economics. Management has proved itself to be competent and shareholder friendly, exercising prudence but also seeking to optimize the outcome for investors through dividends and buy-backs as appropriate.

As a bonus, in addition to its PGM operations, Sylvania Platinum's has recently entered a joint venture, known as the Thaba Joint Venture (Thaba JV), involving a 50:50 partnership with Limberg Mining Company (LMC), an affiliate of ChromTech Mining Company. he venture is expected to start production in the first half of 2025 and runs for 10 years. For the first time, Sylvania will receive a full margin chromite concentrate revenue stream, in addition to PGM revenues. This is expected to significantly enhance the company's earnings, with up to 75% of the JV's revenue over the next four years anticipated to come from chrome production.

Not investment advice - just an idea for you and others to explore further.

Hugo

What is the current above ground inventory for platinum and palladium

I also like Sylvania Good company with 8%growth beginning their 4th quater plus remittance of 50% capital expenditure

I also bought intellego in sweden. Liked the story after doing some research myself.