Can Innovative Solutions and Support Continue Flying? Update on the company and insider selling.

Aviatronics high-growth company.

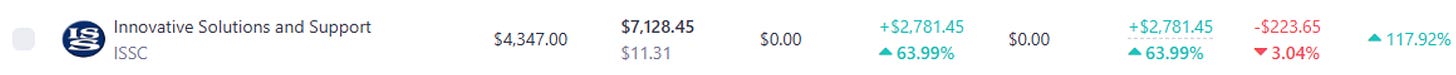

Innovative Solutions & Support (ISSC) has delivered robust results that confirm its initial bull thesis, returning 64% since publication and achieving an internal rate of return (IRR) of over 100%. While the stock has already provided excellent gains, its outlook remains highly attractive given strong revenue trends, rising profitability, and a growing backlog bolstered by strategic Honeywell product line acquisitions.

Here you can read the initial thesis:

Starting with fiscal year 2024, ISSC reported a 35.6% increase in full-year revenues, reaching $15.4 million in the fourth quarter alone—a jump of 18% year over year. Net income for the year came in at $7 million (up 16%), while EBITDA reached $12 million (up 36% and nearly triple its level three years ago). The company’s cash flow also showed strength: operating cash flow rose to $5.8 million, with free cash flow of $5.1 million (up from $1.8 million a year earlier). ISSC’s net debt stands at $27.5 million, or roughly 2x net leverage, supported by an amended $35 million credit facility that provides flexibility for continued investments.

Although the headline results are impressive, more intriguing developments often surface in ISSC’s earnings calls rather than its press releases. Management projects another year of 30%+ top-line growth, driven by healthy end markets, additional synergies from Honeywell acquisitions, and stable government business, including a contract to deliver ThrustSense Autothrottle systems for the U.S. Army’s C-12 Fleet. In step with this growth, ISSC is expanding its production facility by 100%—an investment of $6 million—which aligns with the company’s push to in-source more component assembly and capture higher margins over time.

Another critical growth driver is the company’s backlog, which has swelled to $89.2 million as of September 30, 2024. This figure excludes major long-term OEM programs such as the Pilatus PC-24, Textron King Air, Boeing T-7, Boeing KC-46A, and Lockheed Martin work. Recently, ISSC added $74.3 million of backlog from a Honeywell product line acquisition. Although the gross margin on these military programs is lower than for commercial contracts, management anticipates that most of the profit will still flow to EBITDA because overhead does not rise proportionately with volume. Moreover, the timing of this backlog conversion is likely to be uneven, with a revenue bump in Q2 of fiscal 2025, a dip in Q3 during equipment transition, and a recovery by Q4.

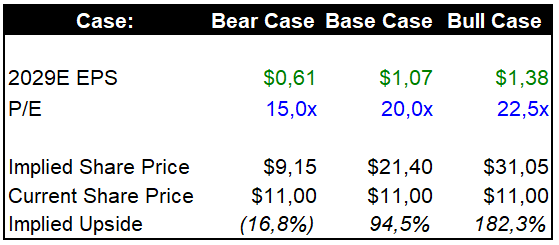

Coupled with the new ThrustSense Autothrottle contract and continued scaling in its overall defense pipeline, ISSC management indicated a plan to surpass $100 million in annual sales—potentially sooner than initially expected—given the accelerating pace of orders and the planned production capacity expansion. From a valuation standpoint, the stock currently trades around $11 per share (about 17x EV/EBITDA). Yet high double-digit top-line growth and rising EBITDA margins could justify further upside. While the share price has already climbed significantly, the ongoing expansion and strong backlog suggest that ISSC may still offer considerable potential, especially as now it leans more towards my initial bullish scenario in which the company could still have 3x potential. Nonetheless, investors seeking new opportunities should consider ISSC’s risk-reward balance relative to other stocks, as the share price is above earlier target levels.

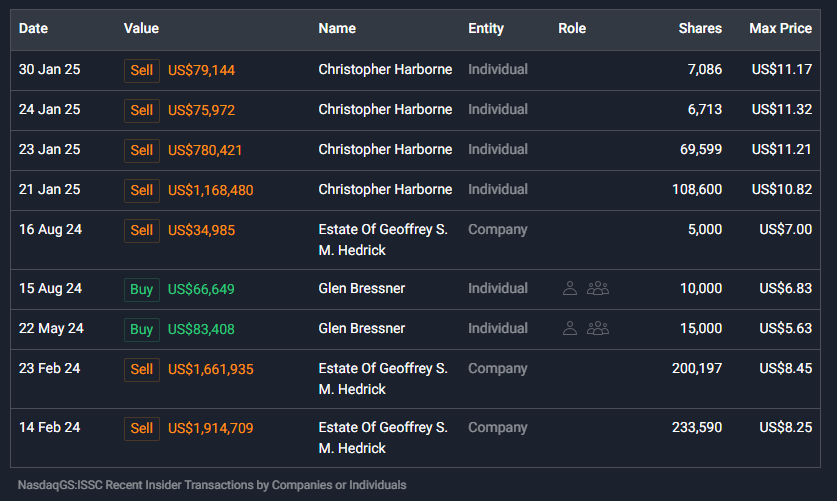

Another thing worth mentioning is that Christopher Harbonne, a large investor who owns 10% of the company and attempted to buy it outright around a year ago, has reduced his stake by approximately 10%. It is always worth noting when influential insiders are selling; however, he still holds a substantial position—worth around $20 million—so I do not view this as a major red flag.

Those wanting more detail about ISSC’s product lines and valuation should consult the comprehensive write-up for context. However, based on headline metrics and commentary from the latest earnings call, ISSC appears poised to maintain its momentum, potentially validating both its valuation and the confidence that current shareholders have placed in this increasingly successful avionics specialist.

We are not adding ISSC to the model portfolio yet, as we see better risk-reward opportunities elsewhere at this time.