Flying Under the Radar: Innovative Solutions and Support’s Undervalued Growth Potential

Huge growth potential at a great price.

Investment Report

NASDAQ: ISSC

Market capitalization:116.2M

Stock price: 6.64

P/E ratio: 17.96

Div yield:

Key points:

Autonomous flight opportunity: Positioned to capitalize on the booming autonomous flight market.

Strong growth potential: Double-digit organic revenue growth with acquisition opportunities.

Solid client base: Contracts with blue-chip clients like Boeing, Pilatus, and Textron ensure steady, recurring revenue streams.

Low market capitalization: ISSC’s low market cap and cyclical industry exposure offer high potential returns for risk-tolerant investors.

Index

Introduction

Business segments

Sector diversification

Honey Well acquisition

Competitive advantages

Major clients

Leadership

Takeover attempt

Order backlog

Autonomous Flight

Growth opportunities

Thesis

Valuation

Risks Conclusion

1. Introduction:

Founded in 1988, Innovative Solutions and Support (ISSC) is a specialized systems integrator and manufacturer in the avionics industry, designing and producing advanced cockpit systems for both commercial and military aircraft. Initially led by founder Geoffrey S. M. Hendrick, a prominent figure in avionics who held nearly 100 patents, ISSC quickly became a key player in the industry. Under Hendrick's leadership, the company capitalized on regulatory changes like Reduced Vertical Separation Minimums (RVSM), leading to a surge in demand for its air data systems and driving revenues to a peak of $63 million in 2006. Over time, ISSC shifted its focus to flat panel display retrofits for older aircraft, establishing a niche position in cockpit avionics. The company has evolved with time developing products that were demanded by the market, with their current product offering they will be able to capitalize on aviation trends such as autonomous flight.

ISSC's earnings bottomed in 2018, as the company faced challenges in turning around its operations. A significant portion of their revenue, over 20%, came from engineering development contracts, which were burdened with razor-thin margins. Compounding this, the company had to dedicate substantial resources to research and development (R&D), when including internal R&D expenses the number approached 40% of total revenues.

After Hendrick's passing in 2022, Shahram Askarpour, the former President of Engineering, took the helm as CEO. ISSC has successfully turned around its operations after divesting from almost all their engineering development contracts, improving margins and achieving a revenue compound annual growth rate (CAGR) of over 20% since 2018. Management remains optimistic about the company's future, confident in its ability to sustain double-digit organic growth. Several catalysts, including the complete sale of shares from the late CEO's trust, new contracts, and increased investor interest, are poised to significantly boost ISSC’s stock price.

Despite not providing formal guidance, ISSC’s leadership has expressed their expectation to grow revenues beyond the $100 million mark in the future. The company is even preparing for expansion by considering the construction of a new manufacturing facility. With its strong foundation, history of innovation, and strategic leadership, ISSC is well-positioned for continued growth and success in the avionics sector.

2. Business segments:

Innovative Solutions and Support (ISSC) operates across three primary business segments: Product Sales, Customer Service, and Engineering Development Contracts. Each segment plays a crucial role in generating revenue and driving the company's growth.

1. Product Sales:

This segment encompasses the sale of equipment to a variety of customers, including OEMs, commercial air transport carriers, aviation companies, and government agencies such as the Department of Defense (DoD). While historically dominated by flat panel display systems (FPDS), this category also includes other key offerings like autothrottles and utility management systems (UMS). ISSC continues to secure significant contracts with OEMs such as Pilatus for UMS, Textron for autothrottles and standby instruments, and Boeing for the KC-46 and T-7 platforms. The stable revenue and margins from these large contracts form a critical part of the company’s overall business, and ISSC is increasingly expanding its presence in the military sector. A recent multi-million-dollar contract for a foreign military platform further underscores the company’s growth in this market.

I am not an expert in aeronautics so I leave you here a product brochure in case someone wants to take a deeper look on how these products work:

https://innovative-ss.com/wp-content/uploads/2023/11/Innovation_aerospace_2023rev10.pdf

In their website they also have all their current patents posted so I leave a link to that too:

https://innovative-ss.com/innovative-solutions-support/iss-patent-portfolio/

Revenue growth:

2024 product sales will be slightly down as the cargo market has been quite challenging this year, we could see some upside as some of the revenues from the military contract will start to be recognized in Q4.

They have a strong product portfolio protected by patents and certifications that allow them to operate successfully in their market, additionally they spend a lot of money on internal R&D (10% of revenues), so they are a technology leader in their niche.

2. Customer Service:

ISSC provides maintenance, repair, and upgrade services to its customers through either field service engineers or its in-house repair facilities. This segment has experienced notable growth, particularly following the acquisition of product lines from Honeywell. The addition of these service-driven sales has enhanced both revenues and profitability in this area, as ISSC supports its customers with the necessary expertise to maintain and optimize their avionics systems.

2024 customer service sales will be around 20 million dollars as we will see the full effect of HoneyWell acquisition.

3. Engineering Development Contracts:

ISSC earns revenue from engineering development contracts when customers require customized systems, such as flat panel display solutions (FPDS) tailored to meet specific requirements. These revenues are usually really low margin and fortunately the group has less than 4% of their revenues coming from this segment.

3. Sector diversification:

The company’s revenues are diversified across three main aviation sectors: military, general aviation, and commercial air transport (cargo). Management is aware of the cyclical nature of these sectors and strategically leverages this diversification. On the last earnings call the CEO said that: when one market, such as cargo, experiences a slowdown, as has been the case this year, the company shifts focus to its other segments. For example, as part of its effort to grow the military segment, ISSC hired a retired veteran to help sell some of their products. This uncommon strategy appears to have paid off, as the company has since secured several notable military contracts.

Currently, 44% of ISSC’s revenues come from the commercial air transport segment, which has been significantly lower this year. Both the military and general aviation segments now represent nearly equal portions of the company’s revenue mix. Looking ahead, I expect the military segment to represent a higher percentage of overall revenues as the company begins recognizing income from its recently awarded contract.

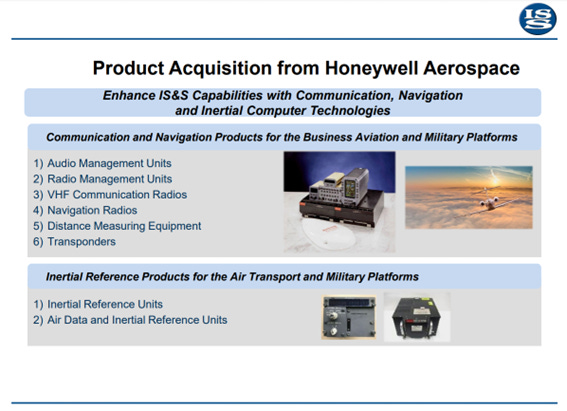

4. Honey Well acquisition:

The acquisition of Honeywell's product lines marks a pivotal moment in Innovative Solutions and Support (ISSC)'s growth strategy, presenting significant opportunities to capitalize on underutilized production capacity, broaden its market reach, and enhance profitability.

Prior to the acquisition, ISSC’s production facility was operating at just 30% capacity, indicating substantial room for growth without the need for heavy capital expenditures. The increased utilization of the facility should lead to greater economies of scale, improving gross margins over time. This operational efficiency is likely to result in a highly favorable impact on ISSC’s profitability. We have been seeing this during 2024, with gross margins improving year over year, and management expects this trend to continue in 2025.

The CEO, in the third-quarter earnings call of 2023, outlined the strategic rationale behind the acquisition. By licensing several product lines from Honeywell Aerospace, ISSC significantly expanded its product portfolio, particularly in the air transport and business aviation markets, with potential expansion into military platforms. This acquisition was expected to boost the company’s annual revenue by 40%, with an even greater impact on earnings. EBITDA was projected to grow by approximately 75% once operations were fully integrated by 2024. Additionally, the CEO emphasized the company’s ability to better leverage its infrastructure, sustain high margins, and deliver accretive earnings starting in 2024.

One year after these expectations were set, the CEO reflected on the success of the acquisition. Over the trailing 12 months, ISSC achieved a 54% increase in consolidated revenue, 75% growth in adjusted EBITDA, and a 28% rise in EPS, exceeding the original projections. Despite some inefficiencies, the company performed well in integrating these new assets while pursuing other growth initiatives. Moreover, the acquisition opened doors to new customer relationships, particularly in international markets where ISSC previously had limited presence.

Historically, these product lines generated $21.5 million in revenue and produced $11.1 million in gross profits, yielding an impressive 51.6% gross margin. The pre-tax income (PBT) generated from these products was $9.55 million, according to the company. Given that ISSC paid a mere 3.8x multiple on this acquisition, it is considered an exceptional bargain, especially in a market where such valuations are rare. Honeywell, a company with a $135 billion market cap, divested these non-core assets to focus on next-generation avionics. The seller’s price insensitivity, combined with a focus on finding a buyer that would not disrupt customer relationships, made ISSC the ideal acquirer. The fact that there were seven bidders for these product lines further validates the quality of the assets ISSC acquired. It is highly unlikely that ISSC ended up purchasing underperforming product lines, particularly considering the strong competitive interest. This, combined with ISSC’s strong post-acquisition performance, reinforces the soundness of the deal.

The deal primarily consisted of a $13 million acquisition of inventory and equipment, with the remainder allocated mainly to goodwill and intangible assets. Although ISSC did not technically purchase the product lines, they received licensing rights to these products indefinitely, making the deal comparable to an acquisition. In addition, the company can use the Honeywell brand when selling or offering technical services related to the licensed product lines, which adds significant market credibility.

ISSC also gained new client relationships through this transaction, which they can leverage. These new clients could benefit from ISSC’s existing products, while some of their old clients may find value in the newly licensed product lines. The ability to cross-sell between these customer groups enhances the value of the acquisition.

The company further built on its success by acquiring additional communication and navigation radio product lines from Honeywell. While smaller in scale, this second acquisition strengthens ISSC’s offerings in military and business aviation markets, further leveraging the underutilized capacity at their Exton facility.

Financially, ISSC has improved markedly post-acquisition. The company financed part of the deal with debt, initially raising its leverage to 2.9x. However, through aggressive debt repayment, ISSC has reduced its debt burden to just $9.3 million, lowering leverage to a manageable 0.8x. This financial discipline not only reduces risk but also positions ISSC for further growth opportunities.

Management has expressed confidence in sustaining double-digit organic revenue growth in the coming years, signaling that these product lines have considerable room for expansion. The addition of inventory from both acquisitions further boosts the accretive nature of these deals, as ISSC can sell or lease the inventory, enhancing cash flow and profitability.

5. Competitive advantages:

Innovative Solutions and Support (ISSC) holds several key competitive advantages that position it strongly in its niche market:

Patent Protection: ISSC has a portfolio of patents, some maturing in 2026-2027, with new patents in the pipeline, ensuring continued protection of its intellectual property and innovations.

Niche Market, Limited Competition: Operating in a specialized segment of the aviation industry, ISSC faces limited competition, allowing it to dominate key markets with highly tailored solutions. This is clearly shown with their margins, GM have been around 50-60%. This year nearer to 50% principally due to some inefficiencies with their Honeywell acquisition which are expected to be solved by next year. These margins are protected as new entrants will need to spend a good amount of money in R&D and wait for the FAA approval before entering the market.

Blue-Chip Clients: ISSC serves top-tier clients like Pilatus, Boeing, and Textron, securing long-term relationships and reliable revenue through stable contracts. This provide them with a strong moat as having a close relationship with the biggest players in the industry gains them an edge against new entrants which will find difficult to build relationships with these clients.

Long-Term Contracts: ISSC benefits from multi-year agreements with clients, providing consistent revenue and reducing competitive threats, stable revenues allow them to invest in R&D and therefore continue leading their niche market.

6. Major clients:

Innovative Solutions and Support (ISSC) has secured a number of high-profile blue-chip clients, many of which are industry leaders worth billions of dollars. Currently, ISSC has four key OEM production contracts, demonstrating its focus on creating stable, recurring revenue streams.

Boeing T-7A Red Hawk Trainer Program – Awarded in 2023, ISSC supplies GPS sensor units for the Boeing T-7A Red Hawk, an aircraft designed for pilot training.

Boeing KC-46A Tanker Program – Since 2011, ISSC has provided Aerial Refueling Operator Control and Display Units for Boeing’s KC-46A tanker. The U.S. Air Force plans to procure 179 tankers by 2027, with deliveries continuing through 2029.

Pilatus PC-24 – ISSC’s Utilities Management System (UMS) has been standard equipment on every Pilatus PC-24 since 2013 under a multi-year production contract.

Textron King Air 260 and 360 – Under a multi-year agreement, ISSC provides its ThrustSense Autothrottle system for Textron’s King Air 360 and 260. The system became standard on the King Air 360 in 2020 and on the King Air 260 in 2021. This contract is expected to drive significant revenue in the coming years, especially as the U.S. Navy has enlisted the Textron King Air 260 for training pilots in various military roles.

In addition, ISSC recently signed a multi-million-dollar agreement with an undisclosed military company, further expanding its portfolio of high-value clients.