Alico Update: Turning Citrus Groves into Florida Real Estate Value

Safe bet, insiders interests aligned

Alico, a Florida-based company with deep roots in citrus farming, has announced a major strategic transformation that will reshape its future. After years of battling declining citrus yields due to citrus greening disease and environmental disasters, Alico has decided to cease citrus operations by 2025 and shift its focus toward land development and diversified farming.

This move marks the end of Alico’s long-standing role as a leading citrus producer and positions the company as a pure real estate and agriculture investment, focusing on monetizing its vast land holdings across Florida. Here’s what this means for Alico’s future—and why it could present an exciting opportunity for investors, with an initial price target of $50

You can read our thesis in Alico here, however a lot has changed since then.

Key Details from the Announcement

Extensive Land Holdings Across Florida

Alico owns 53,371 acres of land across eight counties and 48,700 acres of oil, gas, and mineral rights. With citrus farming no longer viable, the company will now focus on:Entitling land for commercial and residential development.

Maintaining diversified agricultural operations on 75% of its current land.

Immediate Land Monetization Opportunities

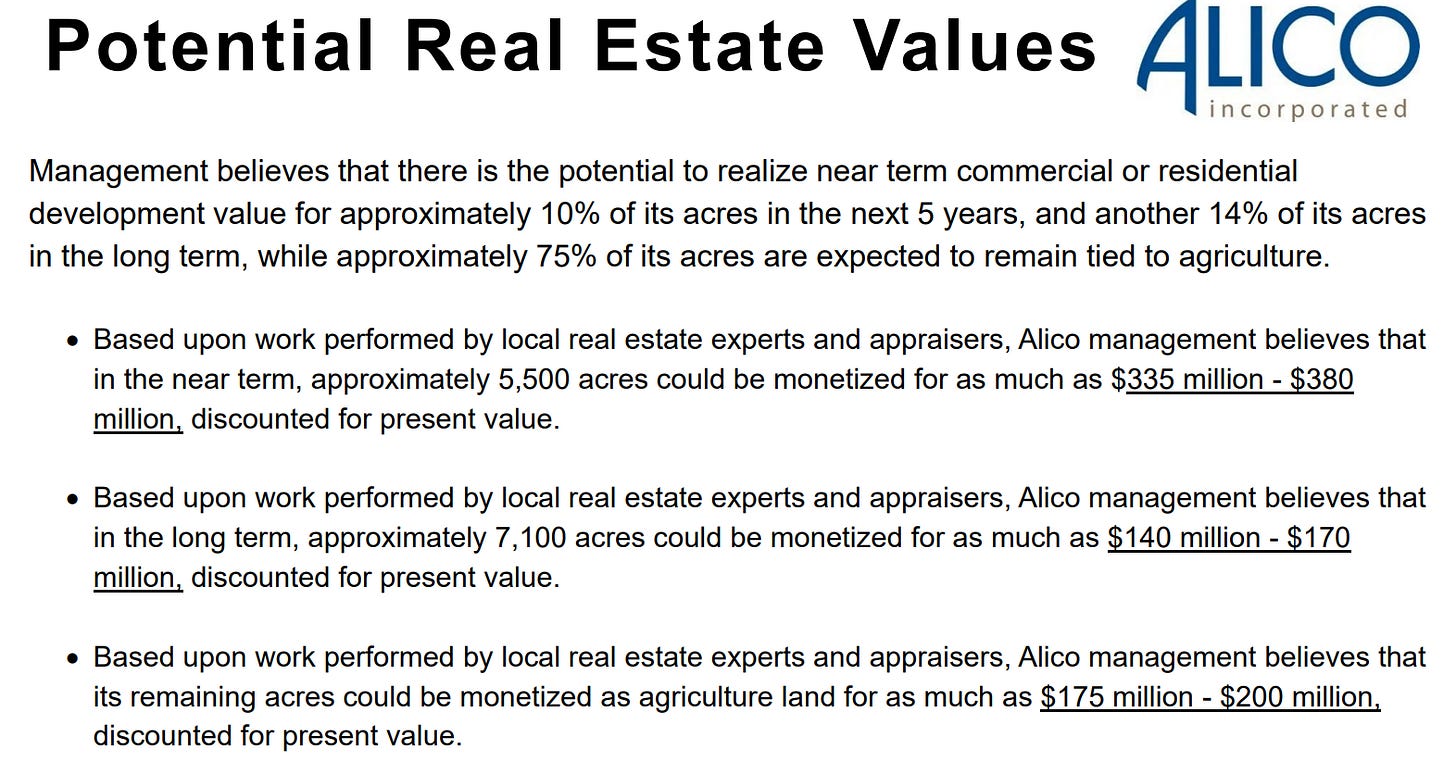

Alico expects to sell 5,500 acres in the near term, with proceeds estimated between $335 million and $380 million (discounted to present value). Most of these proceeds are likely to come from the Fort Myers 4,500-acre grove, a highly valuable parcel.Long-Term Land Value

Over the long term, Alico management estimates that approximately 7,100 acres could be monetized for $140 million to $170 million, with an additional $175 million to $200 million coming from agricultural land sales. This brings the total estimated land value to $650 million to $750 million.Improved Financial Stability

With the wind-down of citrus operations and the shift toward real estate and diversified agriculture, Alico expects to:Recognize positive cash flow by the end of fiscal year 2025, after land sales and restructuring costs are realized.

Have sufficient cash reserves to cover operating expenses for at least two additional years without requiring further land sales.

Commitment to Shareholder Returns

While Alico hasn’t yet specified how it will return capital to shareholders, management’s past actions suggest that share repurchases or a special dividend are likely. The company has historically been prudent in capital allocation, and with significant land sales on the horizon, investors can expect meaningful returns.

What This Means for Investors

This strategic pivot turns Alico into a low-risk real estate and agriculture play with significant upside potential. The company’s vast land holdings, valued at $650 million to $750 million, provide a solid margin of safety for investors. Given that Alico currently trades at a deep discount to its net present land value, the stock offers an attractive opportunity.

Upside Potential

Near-term catalysts: The upcoming Fort Myers land sale, expected to generate up to $380 million, could be a key trigger for share price appreciation.

Long-term optionality: With 25% of its land targeted for development and ongoing agricultural operations, Alico offers both stability and growth potential.

Potential capital returns: Investors could benefit from dividends or share buybacks, which would further enhance shareholder value.

Downside Protection

Even in a worst-case scenario, Alico’s extensive land holdings provide a solid safety net. The company’s management has already demonstrated a commitment to prudent capital management, and with cash flow expected to turn positive by 2025, the risk of capital erosion is minimal.

Final Thoughts

Alico’s shift away from citrus farming may mark the end of an era, but it opens the door to a new chapter focused on real estate monetization and agricultural diversification. With substantial near-term land sale proceeds, a clear path to positive cash flow, and potential for shareholder returns, Alico offers a compelling investment opportunity at its current valuation.

Additionally, we have to consider that the CEO receives a significant bonus if the company is sold for over $50 per share, and management has incentives tied to bonuses if the stock price rises to between $35 and $50. Management could achieve this relatively easily, as selling the Fort Myers parcel of land alone would result in a significant increase in cash. It is important to note that these assets were acquired by Alico a long time ago, meaning the capital gains tax on the sale will be substantial. In my view, the fair value of the stock is around $50 per share, using a conservative estimate, and there are several key catalysts that could help us reach that target.

Whether you're betting on Florida’s booming real estate market or seeking a safe, asset-backed investment, Alico’s strategic transformation presents an attractive case for long-term investors.

Disclaimer:

The information provided in this article is for informational purposes only and should not be considered financial advice. The content does not constitute a recommendation to buy, sell, or hold any security or investment. Always do your own research and consult with a professional financial advisor before making any investment decisions. Investing in stocks involves risk, including the potential loss of principal. Past performance is not indicative of future results.