The Forgotten Commodity: Coal’s Quiet Resilience in a Changing World

Investment Thesis on the US Coal Sector

Introduction

The coal industry is facing a long-term decline, particularly in developed nations where environmental concerns and the push for renewable energy sources are becoming more prevalent. Despite this, coal remains a crucial energy and industrial resource in many parts of the world. Almost a billion people still live without electricity, and over a billion more lack reliable energy sources. These populations, particularly in developing countries, are expected to continue using coal, especially for thermal energy generation. Additionally, metallurgical (met) coal is essential for producing steel and other metals, which are critical for economic development and technological progress. With the rapid industrial expansion of China and India, demand for met coal is expected to remain strong for years to come. Even in the developed world, the need for new ferric materials will persist, as recycling alone cannot meet the demands of an evolving civilization.

Investors can sometimes achieve exceptional returns even in declining industries. A prime example is the cigarette industry. Despite steady declines in cigarette consumption over recent decades, tobacco stocks have significantly outperformed major indices. This illustrates that well-managed companies in shrinking markets can still deliver substantial value to shareholders, particularly through disciplined capital allocation, such as stock buybacks and dividend payments.

As you can see tobacco stocks have outperformed the overall market for 40 years, this is a perfect example of what could happen with coal due to the low valuations and share buyback programs these companies have.

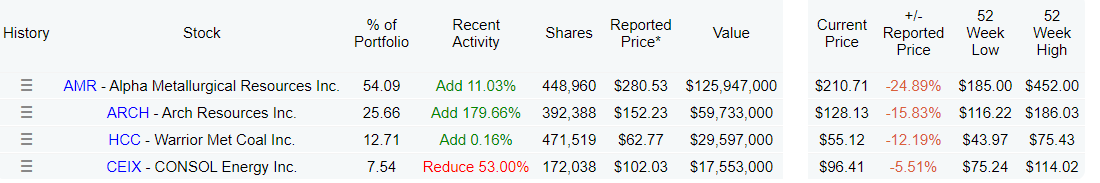

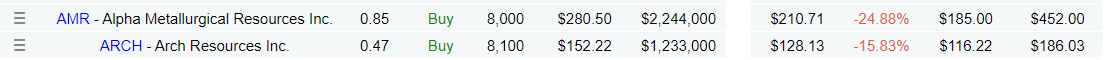

Some big investors are getting really interested in the coal market. A prime example is Mohnish Pabrai, a renowned value investor, who has made a significant investment in coal, signaling his belief in the potential for outsized returns in the sector. His investment underscores the thesis that, despite the widespread belief that coal is a "dead" industry, there are still opportunities for savvy investors to capitalize on mispricing and supply-demand imbalances.

As you can see all of his 4 US holdings are coal mining companies, three of them only produce met coal and one of them (CONSOL) produces both.

Pabrai explained in an interview why he liked coal stocks:

“Recently, the two stocks I found in the US, which I got very excited about, are like that. I never thought I'd find that again, where it's this kind of anomaly where the guaranteed cash flows are exceeding the market cap and all of that.”

In this statement he was referring to his positions in Alpha Metallurgical Resources and CONSOL, we will dig deeper in each of these companies in the following weeks.

Recently, Guy Spier, another renowned investor, started a position in two metallurgical coal miners.

Why the Opportunity Exists

The primary reason this opportunity exists is that most European and American investors, who control the bulk of global capital, have written off coal as a viable investment. This sentiment is further compounded by the rise of Environmental, Social, and Governance (ESG) investing, which has made coal "uninvestable" for many large banks and institutional funds. This has created a situation where coal assets are undervalued, despite their continued importance in certain regions of the world, particularly in developing economies. As demand for coal persists or even grows in certain areas, this undervaluation presents a compelling opportunity for contrarian investors.

Met coal and thermal coal

There are two main types of coal, thermal coal which is used to produce electricity and metallurgical coal which is used to produce primarily steel, we will take a look at the future for these two.

Thermal coal

As illustrated in the chart, Asia remains a major consumer of coal, and there is no sign of significant reduction in the short term. While China has made efforts to reduce its reliance on thermal coal, and some success has been observed in terms of reducing coal’s percentage in its total energy mix, the absolute amount of coal consumed continues to rise. As more people in China move out of poverty, their energy consumption increases, which includes greater use of coal. India is on a similar trajectory, with coal consumption expected to rise as more of its population gains access to electricity and moves out of poverty. In these regions, newly empowered populations prioritize affordable and reliable electricity, often regardless of the energy source.

As a result of these factors, global coal consumption recently reached 8.7 billion tonnes for the first time in history, driven by the energy demands of emerging economies, particularly in Asia.

Metallurgical Coal

Global steel production has seen steady growth over the last century, with a particularly sharp increase in the past two decades, driven largely by rapid industrial expansion in Asia. As urbanization continues in the region and construction activity in developing countries accelerates, the demand for steel is expected to rise significantly in the coming decade. Metallurgical (met) coal, a key component in steel production, plays a vital role in this process. On average, producing one ton of steel requires approximately 0.7 tons of met coal, highlighting its critical importance in the global steel supply chain.

U.S. met coal has consistently been priced at more than twice the value of thermal coal, which is used mainly for power generation, in six of the past seven years. This price disparity reflects the distinct uses of these coal types. Between 2001 and 2023, U.S. met coal was sold at an average of 90% higher than thermal coal. The premium is due to met coal’s superior quality, characterized by lower ash and sulfur content, making it ideal for use in blast furnace steelmaking. Additionally, met coal is converted into coke, an essential material used as both fuel and a reducing agent in steel production, which further enhances its value.

The majority of U.S. met coal is destined for export markets. In 2023, U.S. met coal production totaled approximately 67 million short tons, with 76% of that volume (51 million short tons) exported to steel manufacturers and coke producers worldwide. In contrast, the bulk of U.S. thermal coal is consumed domestically, with only a small portion exported. The demand for U.S. met coal surged in 2022, particularly in response to trade sanctions on Russian coal—one of the key global suppliers—following geopolitical tensions and supply chain disruptions.

The U.S. met coal industry enjoys relatively limited global competition. Aside from the U.S., only a few other countries—namely Australia, Canada, and Russia—possess the reserves and infrastructure to produce and export significant quantities of high-quality met coal. China, the world’s largest met coal producer, uses most of its supply domestically, leaving room for U.S. producers to meet the growing international demand.

Given the forecasted growth in steel production and the sustained elevated prices of met coal, U.S. metallurgical coal producers are well-positioned to capitalize on strong global demand and limited competition. This makes U.S. met coal a highly profitable segment within the broader coal market.

Supply and Demand Imbalance

Over the past decade, capital expenditures (CAPEX) in the US coal industry have been significantly reduced. Between 2010 and 2022, investment in new coal capacity remained low due to pessimism about the sector’s future and the impact of ESG policies. However, this reduction in CAPEX has led to a substantial imbalance between supply and demand. In recent years, demand for coal, particularly from China and India, has begun to increase, putting upward pressure on prices. During this last year prices have stabilized and are expected to remain stable.

Looking forward, the industry is expected to ramp up capital investments from 2023 to 2026 to meet this growing demand. This surge in CAPEX will allow US coal miners to benefit from the increased production in coal in Asia, thanks to this we could see the revenues of these companies significantly increase.

Potential for Shareholder Returns

One of the key factors that could drive significant shareholder returns in the coal industry is management’s use of capital. If management teams prioritize share buybacks as a primary method of returning capital to shareholders, this could create substantial value. With high free cash flow and a shrinking industry, buybacks could significantly increase earnings per share and offer outsized returns for investors.

Alpha Metallurgical Resources has set a strong precedent for the use of share buybacks in the coal industry, having increased its share price nearly 100-fold from the COVID-19 crisis to its recent peak in January 2024. However, it's important to note that the significant rise in metallurgical coal prices over the past few years has been a major contributor to these impressive returns. In the past year, the stock has experienced a considerable decline, primarily due to falling metallurgical coal prices, which have compressed profit margins. Despite this, the company has been aggressively repurchasing its shares and is likely to continue doing so in the coming years.

Other companies are starting to do the same or will have the possibility to do it in the future. The great opportunity here exists because lots of companies are still investing into the development or expansion of new mines, therefore once this investment is finished and their revenues and profits rise significantly, they will be able to aggressively buy back lots of their own shares, increasing shareholder value.

The Bear Case for Coal

While there are many reasons to be optimistic about the coal sector, it is essential to consider the potential risks and bear arguments:

1. Natural Gas is Cheaper: One of the main competitors to coal is natural gas, which is often cheaper and cleaner. As the world transitions to cleaner energy, natural gas could replace coal more quickly than expected, particularly in thermal energy production. Some investors think that green hydrogen can represent a threat to carbon demand, however the technology needed is still very expensive and is not possible to make this work at a global scale.

2. Transition Speed: The speed at which the world transitions away from coal is the most crucial factor in the bear case. The coal market is currently priced as if the transition will be completed within a decade. However, if this transition takes longer—perhaps another 20 years—investors could see significant profits before coal is phased out. A slower transition would allow the industry to maintain profitability for an extended period.

3. China’s Actions: China's rapid expansion of coal production, coupled with the potential for steel production to decrease faster than expected, poses a risk to coal prices. If China, the world's largest consumer of coal, significantly reduces its coal consumption or production, this could negatively impact the global coal market.

4. Real Estate Development: While demand for virgin steel is expected to persist, especially in infrastructure projects, any slowdown in new real estate development or industrial projects could reduce the need for new steel and, by extension, metallurgical coal.

Companies to look at.

Luckily, super investors have already done their due diligence and selected stocks they believe could be winners, which makes it easier for us to identify the companies we’ll be focusing on. I will summarize these investments in a few paragraphs, but if you want a complete analysis, subscribe to receive the full breakdowns I’ll be publishing over the coming weeks.We’ll primarily focus on U.S. companies that produce metallurgical coal, as it appears to have much more stable long-term demand. Steel will continue to be a crucial material in the future, and given the challenges of producing “green steel,” it seems that using high-quality met coal, such as the kind produced in the U.S., will remain the only viable option. We’ll also examine some “cannibal stocks” (companies aggressively buying back shares) alongside companies like HCC, which are poised for interesting growth in the near term.

Coal prices have dropped significantly since their peak in 2022, leading to a substantial reduction in margins for coal mining companies. The demand for metallurgical coal has also decreased, primarily due to the real estate collapse in China and fewer real estate projects in the U.S. These two factors are likely to dissipate in the medium term, as China's growth trajectory continues and lower interest rates stimulate new real estate construction in the U.S. As a result, steel demand will rise, driving up the demand for met coal, which will in turn increase its prices and improve profitability.

I won’t discuss valuations or potential price targets just yet, as I’ll reserve that more detailed analysis for the full thesis I will release on these stocks.

Alpha metallurgical resources

Alpha Metallurgical Resources (AMR) has been aggressively reducing its outstanding shares, lowering the total from 19.54 million in Q1 2022 to 13.11 million in Q2 2024. This reduction has been fueled by the company’s decision to suspend dividend payments and focus its free cash flow on share buybacks. With $1.1 billion already spent on buybacks from its $1.5 billion program, there is still $400 million allocated, representing 15% of the remaining shares. The potential for a new buyback program announcement could serve as a significant catalyst for the stock.

Even under a highly pessimistic scenario where AMR's long-term free cash flow drops to $250 million annually, the company would still be able to repurchase around 9% of its current market capitalization each year. If free cash flow remains steady at current levels, the company could buy back over 15% annually. This aggressive buyback strategy forms the core of AMR’s investment thesis, as continued buybacks at these levels could significantly increase shareholder value over time.

AMR's cost per ton of coal was $110 in the last quarter, while the average selling price for their metallurgical coal was $142 per ton, reflecting a decline both quarter-over-quarter and year-over-year. Although coal prices are difficult to predict, the company has secured 71% of its 2024 metallurgical coal production at an average price of $157.97 per ton, providing some stability. Additionally, AMR’s thermal coal production, though minimal, is fully priced for 2024 at $75.96 per ton.

With the company’s focus on buybacks, cost efficiency, and future catalysts such as a potential new buyback program, AMR presents a compelling long-term investment, especially in the metallurgical coal market where future demand could rise with economic recovery in key sectors.

CONSOL and Arch Resources Merger.

On August 21, 2024, a merger between Arch Resources and Consol Energy was announced. The merger between Arch Resources and CONSOL Energy is set to create Core Natural Resources, potentially the largest and most diversified coal company in the U.S. The combined entity will hold a world-class portfolio of low-cost, high-quality coal assets, with significant operations in both metallurgical coal (used for steelmaking) and thermal coal (used for power generation). The diversity of coal types and geographic spread across multiple regions ensures that the company will serve a broad range of global customers, from steel manufacturers to industrial and power-generation clients. With ownership in key export terminals, the new entity will be well-positioned to tap into global coal markets, enhancing its logistics capabilities and ensuring reliable coal delivery.

The merger is also expected to generate significant cost savings, with annual operational synergies estimated between $110 million and $140 million. These savings will come primarily from logistics optimization, procurement efficiencies, and the ability to blend coal from multiple sources to improve economies of scale. This cost efficiency will allow Core Natural Resources to maintain competitive production costs, making it more resilient during market downturns.

In terms of capital allocation, the new management team is committed to returning value to shareholders primarily through share buybacks and a modest quarterly dividend. The combined company’s strong free cash flow, projected at $1.4 billion annually (excluding synergies), will fuel these returns.

In summary, the merger between Arch Resources and CONSOL Energy creates a coal giant that is diversified, cost-efficient, and focused on delivering capital returns through buybacks and dividends. The strategic positioning in both metallurgical and thermal coal markets, combined with operational synergies, makes Core Natural Resources a highly attractive player in the coal industry for years to come.

In the next few weeks I will write a whole thesis on the merger and how we can invest in it. I think this might be a great opportunity as it offers diversification between met and thermal coal.

Warrior Met Coal:

Warrior Met Coal (HCC) is a prominent producer of high-quality metallurgical coal, focusing solely on coal used for steelmaking. This gives them a strategic advantage in the market, as their premium-grade Hard Coking Coal is essential for efficient steel production. With lower emissions and higher blast furnace efficiency compared to other types of steelmaking coal, Warrior Met Coal is well-positioned to meet the growing global demand for steel, particularly from industrial and developing economies.

The company’s operations are strategically located in Alabama, just 300 miles from the port of Mobile. This proximity allows them to ship coal via sea routes, providing flexibility in terms of buyers and markets. Shipping seaborne coal opens opportunities for global distribution, which is more stable compared to relying solely on domestic demand. Warrior Met Coal doesn’t own responsibility for the product beyond loading it onto buyers' barges, which minimizes logistical risks.

Warrior Met Coal's plans for growth are centered around the development of the Blue Creek mine, a project that, when fully operational in 2026, will boost their production capacity by approximately 60%. This could increase their annual output from 8 million tonnes to 12 million tonnes, with potential for further expansion. By focusing on operational efficiency and cost-cutting strategies, the company benefits from economies of scale, allowing them to secure lower transportation costs and maintain their position as a low-cost producer. Additionally, the potential construction of their own barge load-out facility will further streamline operations and lower costs.

Though Warrior Met Coal operates in a cyclical industry where demand for steel and coal can fluctuate with economic conditions, the company’s strong margins, efficient operations, and premium product offering position it well to weather downturns. For investors willing to hold through the cyclical nature of the coal market, Warrior Met Coal represents a stable, long-term investment with solid returns expected once the Blue Creek mine reaches full capacity.

Conclusion.

The US coal industry presents a unique investment opportunity for those willing to look beyond the surface and invest in a sector that many have written off. While there are significant challenges, particularly related to the global energy transition and competition from cheaper alternatives like natural gas, the demand for both thermal and metallurgical coal is expected to remain robust, especially in developing economies. Additionally, years of underinvestment have led to supply shortages, and coal prices are likely to remain elevated in the near to medium term. If management teams focus on returning capital to shareholders through buybacks, the potential for outsized returns increases. For contrarian investors like Mohnish Pabrai, the coal industry may offer substantial rewards despite its long-term decline.

As coal companies complete their investments in new mines, they will be able to significantly improve cash flows, which can be used to reward shareholders through dividends and buybacks. However, selecting the right companies is crucial for investors to fully capitalize on this opportunity. In the coming weeks, I will be covering some of the most interesting companies in this sector individually, so stay tuned and subscribe to ensure you don’t miss out on this content.

Disclaimer:

The information provided in this article is for informational purposes only and should not be considered financial advice. The content does not constitute a recommendation to buy, sell, or hold any security or investment. Always do your own research and consult with a professional financial advisor before making any investment decisions. Investing in stocks involves risk, including the potential loss of principal. Past performance is not indicative of future results.