Safer Platinum Exposure: The Best PGM Miner You’ve Missed.

A deep dive on Valterra Platinum—the overlooked PGM leader with asymmetric upside

This miner is, in my view, the best way for most investors to gain high-quality exposure to the PGM market. Platinum is up 47 % year-to-date, yet the company’s share price has lagged while peers have almost doubled. The under-performance stems not from weak fundamentals but from a demerger overhang that is now clearing, giving us an attractive entry point into a world-class producer.

The company has taken advantage of the PGM bear market to optimise its operations, driving AISC below US $1 000—a remarkable feat for a miner of this size. It achieved 27 % EBITDA mining margins and positive cash flow while peers were losing money. In 2024, it posted US $400 million in FCF despite one-off demerger costs and maintained a healthy net-cash position. For me, this is the perfect exposure—capable of weathering any PGM environment.

Many subscribers are already familiar with PGMs from our earlier coverage, but if you are new to the space, I have linked a free 34-page market report below. Feel free to read it before investigating this opportunity further.

Super-Cycle Setup: Why PGMs Could Deliver Triple-Digit Gains

Do you want to know which commodity is poised for a new super-cycle? It is a metal so critical to United States industry that the Trump administration excluded it from tariffs. China imported record volumes last year, and the metal is indispensable to the green transition. At the same time, chronic supply problems keep the market in deficit, demand remains firm, and analysts continue to predict surpluses that never materialise. With prices now below breakeven for most producers, many mines are closing, all but guaranteeing that any forecast surplus will be pushed even farther into the future. A supply crunch could therefore deliver multibagger returns for the small handful of listed miners while limiting downside risk.

Supply of PGMs is dominated by an oligopoly of three miners that control virtually all known reserves. Today, in Undervalued and Undercovered, we will take a deep dive into one of them: Valterra Platinum (VALT:LSE), formerly Anglo American Platinum—or “Amplats.” Valterra remains the world’s largest PGM producer by market share. Its share price has fallen from more than US $150 in early 2022 to the low-40s today, under-performing peers during the recent rally. The key question is whether this pull-back presents an attractive entry point, or whether better risk-adjusted opportunities lie elsewhere in the sector.

We will answer that question with a thorough review of this large yet under-covered PGM miner. Despite its scale, Valterra receives surprisingly little analyst attention. We will examine its mining operations, cost structure, future prospects, peer comparisons, valuation, and key risks.

1. Introduction:

Anglo American is the market leader in platinum and rhodium, capturing most global production in both metals. It enjoys exceptional average EBITDA margins across the cycle and commands a leading PGM portfolio with more than 600 million attributable ounces of PGMs—a resource base far larger than that of its competitors. What is even more compelling is the company’s lower cash cost per ounce produced, which makes this resource base more valuable.

The company is clearly focused on maintaining strong margins throughout the cycle. Unlike many other miners, it has not needed to tap debt markets to fund capex or other needs; instead, it holds a net cash position of US$ 888 million and generated US$ 400 million in free cash flow while most peers were losing money. Its low cash cost per ounce remains a core operational focus and a major competitive advantage, emphasizing quality over quantity and allowing the firm to remain highly profitable across the cycle.

The group closed FY 2024 at the upper end of guidance, delivering strong operational results despite weak prices. By metal, roughly 46 % of Valterra’s output is platinum and 33 % is palladium; although rhodium tonnage is low because of its elevated price, it still makes a notable contribution to revenue. The remainder comes from other PGMs and a small amount of gold. This blend provides meaningful palladium leverage while preserving a solid platinum base.

Margins remain robust even in a downturn, supporting healthy operating cash flow that funds capex projects aimed at boosting operational efficiency and preparing growth-optionality projects.

With US$ 888 million of net cash and projected 2024 operating cash flow of US$ 300–400 million—even as many rivals are loss-making—Valterra is well positioned to navigate the current down-cycle. At the top of the cycle, free cash flow has historically ranged between US$ 3–5 billion. Against a US$ 10.8 billion market capitalisation, that upside suggests Valterra may offer the most attractive risk-reward profile among the “big three” PGM miners.

2. Comparison with the big three:

As we will show in this section, Valterra Platinum is a much higher-quality company than its peers Sibanye and Impala, offering a compelling valuation for best-in-class assets that can produce free cash flow even in major downturns.

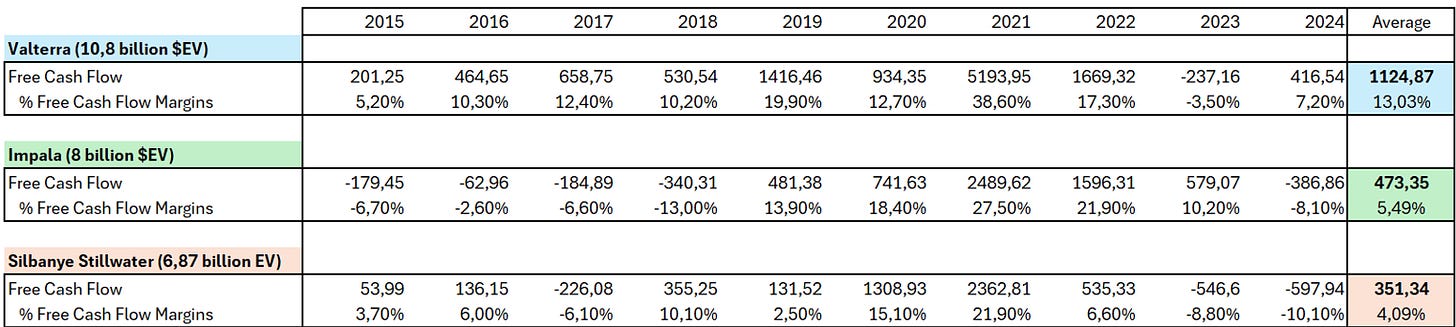

First, we will look at FCF.

As you can see, margins are far stronger than those of its peers, averaging more than double their level. On an adjusted basis, Valterra trades at roughly 9.6 × average FCF, Impala at 16.9 ×, and Sibanye— the most expensive— at 19.55 ×. Over the cycle, this valuation is very favourable for Valterra, making it a clear long-term bet on PGM prices that relies less on short-term volatility.