Piraeus Port Authority, a monopolistic company with growth opportunities:

Monopolistic giant trading at a bargain multiple

Investment Report

FRA: PZE

Market capitalization: 653.78 million euros

Stock price: 26€

P/E ratio: 9.8

Div yield: 5.10%

Key points:

Variety of opportunities to further expand the port and drive revenue growth in the coming years.

The company has recently settled a tax fine and will return to paying taxes at the regular rate.

PPA holds a monopolistic position that is virtually impossible to disrupt.

The company benefits from a diversified source of high-margin revenue streams, making it less vulnerable to economic downturns.

The Greek economy is expected to grow in the coming years, which will likely increase the volume of local cargo at the port, boosting revenues and profitability.

1. Overview:

Piraeus Port Authority (PPA) manages the largest port in Greece, known as the Port of Piraeus. This extensive port spans over twenty-four kilometers of coastline and covers more than five million square meters. Strategically located at the intersection of major sea routes connecting the Mediterranean with Northern Europe, the Port of Piraeus serves as a crucial transportation and trade hub. It connects the Greek islands with the mainland and functions as an international center for marine tourism and cargo transportation. The port’s operations are diverse, including activities such as cruise services, coastal ferry and passenger services, container and car cargo handling and ship repairing. Piraeus Port services over 22,000 ships annually and over 1.5m passengers positioning the port as the fourth largest in Europe in terms of containers and the first port in Europe in terms of passengers.

Company History

The Piraeus Port Authority was initially established as a public law entity under Greek legislation in 1930. The organization underwent several legal transformations, including a restatement by Compulsory Law in 1950 and further ratification in 1951. The company remained under government ownership for many decades, playing a pivotal role in the country’s maritime infrastructure.

In 1999, PPA was transformed into a stock corporation (société anonyme), marking the beginning of its journey toward privatization. The first significant step in this direction occurred in 2002 when the Hellenic Republic granted PPA the exclusive right of use and exploitation of the land, buildings, and infrastructure of the Port of Piraeus for an initial term of forty years, as part of the 2002 Hellenic Republic Concession Agreement (HRCA). This agreement laid the groundwork for the port's modernization and expansion under PPA's management.

In the year 2010 the company entered a long-term lease arrangement with Piraeus Container terminal, a subsidiary of COSCO, leasing to PCT the right to use and exploit of Pier 2 and Pier 3 for an initial term of 30 years, that later was increased to 35 years.

In April 2016, the Hellenic Republic Asset Development Fund (HRADF), which was the major shareholder of PPA at the time, conducted an international public tender process to sell a majority stake in the company. The tender process resulted in the sale of the majority of PPA’s shares to COSCO HK Ltd, a subsidiary of the Chinese shipping giant COSCO. The transfer of shares was completed in August 2016, marking the beginning of a new era for the Port of Piraeus under the leadership of COSCO, which has since aimed to further expand and develop the port’s capabilities and global reach.

2. Business model:

Piraeus Port Authority (PPA S.A.) operates the Port of Piraeus with exclusive rights to utilize and manage this strategic facility. The company generates its revenue through two primary segments: cargo handling activities and passenger traffic activities. Both segments have consistently demonstrated strong financial performance, supported by high EBITDA margins that have potential for further growth.

The company must pay a 3.5% fee of all revenues except from financial income to the Greek State. This fee is not high and does not heavily affect the group profitability.

Now we will deep further into the different revenue streams of the business.

2.1 Cargo handling activities.

Container terminals:

In the cargo handling activities, the container terminals play a pivotal role. Pier 2 and Pier 3 are operated under a concession agreement with Piraeus Container Terminal (PCT), a wholly owned subsidiary of COSCO. These piers have a combined estimated capacity of 6.2 million TEUs annually, under current conditions traffic has been lower, resulting in less revenues for PPE, however this indicates that there is room for organic growth in this segment.

Under the terms of the agreement, PCT pays PPA 24.5% of its annual consolidated revenues. Additionally, PCT pays an annual lease, which is based on the length of the berthing dock and the surface area of the quays, with a minimum annual escalation of 2% on top of the Greek Consumer Price Index (CPI). This lease arrangement, established in 2010, is set to continue for at least 35 years. The segment involving Pier 2 and Pier 3 is highly profitable, with an EBITDA margin of 86.3%.

Container Terminal Pier 1, with an annual handling capacity of up to 1.3 million TEUs and a storage area of 72,400 square meters, only recently became profitable in 2022. In 2023, the terminal generated €45.4 million in revenue and €7.5 million in EBITDA, achieving a 16.5% EBITDA margin. There is potential for further margin expansion as operations continue to mature and improve. As we will see later the average margin earned by pier operators in Europe is significantly higher than 16.5%.

Despite TEU throughput dropping 20.7% from last year PPE accomplished a notable increase in revenues driven by an increase in local cargo and other value-added services.

For the first quarter of 2024 the company reported that the container terminal pier 1 recorded a -4% traffic increase from last year, this was partially offset by the 65.6% increase in domestic cargo which is much more profitable for the company, the concession fee was down -7.8% YoY due to the decrease in cargo compared from last year, mainly as a result of the unstable conditions in the Suez Canal Area.

Car terminal

The car terminal at Piraeus Port has a storage capacity of up to 11,800 vehicles and has benefited from the mass importation of cars, particularly from China. However, the recent tariffs imposed by the European Union on Chinese cars could potentially slow the growth of this segment. Currently, the car terminal operates with an EBITDA margin of 54.9%.

During the first quarter of 2024 the company saw a decrease in loads mainly due to the dysfunction in the supply chain. However, this situation offered significantly increased storage services fees which led to the segment growing revenues YoY.

2.2 Passenger handling activities

Cruise terminal

In passenger handling activities, the cruise terminal is a significant contributor to PPA's revenue. In 2023, the port served 1.5 million passengers across 760 cruise ship calls, resulting in an EBITDA margin of 56%. Looking forward to 2024, the terminal has already secured 850 cruise calls, indicating strong demand and potential for increased revenue.

This segment had an excellent first quarter with record revenues and profitability, the management expects FY 2024 to be another record year for the cruise segment both in terms of revenue and profitability.

Ferry terminal

The ferry terminal at Piraeus Port, the largest passenger port in Europe, provides swift access to key tourist destinations in Athens, with travel times of around 30 minutes. This terminal is vital in facilitating both local and international passenger traffic.

The Ferry Terminal saw also a small increase compared to last year following the positive trend of the Greek economy.

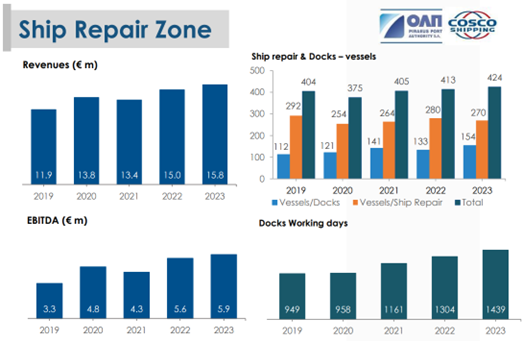

Ship repair zone

PPA manages five dry-docks fully equipped with cranes, this segment has steady revenue but with very low growth. EBITDA margins are quite stable and last year were at 37.5%.

PPA is benefitting from the improvement in economic conditions of Greece, with more local cargo being shipped to the port driving increased revenues and profitability, moreover the increase in tourism will also drive revenue growth in the future.

Greece is expected to be one of the fastest growing economies in the UE with GDP forecasted to grow over 2% for the next three years.

3. Concession agreement:

The pivotal moment in PPA’s history came in 2002, when the Hellenic Republic granted PPA the exclusive right to use and exploit the Port of Piraeus. This concession, originally set for a forty-year term, was formalized under the 2002 Hellenic Republic Concession Agreement (HRCA). The agreement allowed PPA to manage and develop the port’s facilities and operations, facilitating significant investments and improvements in the port’s infrastructure and services. The agreement was later amended in 2008, extending the concession term by an additional ten years.

The company must pay a fee of 3.5% of all revenues except financial income, these fees will be at least 3.5 million, therefore because there will be a fixed payment, under IFRS 16 a lease-liability and a right of use asset were created. The lease-liability represents the future value of all the future fixed payments until the end of the lease and is currently valued at 63.160.340,68€. Therefore, the fixed payments appear in the financing activities section of the cash flow statement.

The company has the exclusive right to use and exploit the Port of Piraeus until 2052 so for us investors there is not any concern about losing this concession and therefore there should be no negative impact in the valuation.

4. Competitive advantages:

The competitive advantage of the company is clear, they have the exclusive right to use and exploit one of the biggest ports in Europe, giving them a monopolistic position in the Piraeus area with no direct competitors. However, due to this monopolistic position, they do not have complete freedom to set prices as they wish; any price increases must be reviewed and approved by the Greek government.

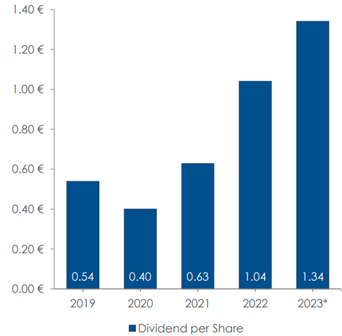

5. Dividend payout:

The company has significantly increased its dividend over the last few years, with this year's payout ratio reaching 50% of net profitability, up from 40% in 2019. This conservative dividend policy allows the company to reward shareholders while also providing the flexibility to continue improving its current facilities.

The company pays their dividend once a year after the financial year has finished.

6. Sector analysis:

If we compare PPA to its industry peers, we can see that they have ROIC and EBITDA margins on the higher end of the sector, however the valuation is less than half of the industry average.

As we can see the Pier 1 terminal is clearly underperforming in terms of margins compared to other ports, PPA has higher margin segments than other ports as they have some of their facilities leased and as they manage the car and passenger terminals which are usually more stable and higher margin.

My thesis is that PPA should be able to increase their long-term EBITDA margin to at least 57% primarily driven by Pier 1 EBITDA margin improving and the other segments margins slightly expanding as there is more local cargo being shipped to the port as the Greek economy continues to grow strongly over the following years.

7. Leadership:

PPA S.A.'s leadership, under the guidance of Ms. Li Jin, who has extensive experience with COSCO, reflects the influence of its majority shareholder, COSCO. Since COSCO acquired a controlling stake in PPA S.A. in 2016, the company has maintained a focus on financial stability, including consistent dividend payments. While it is reasonable to expect that PPA's financial strategies might align with COSCO's broader goals, particularly in terms of prioritizing dividends, this approach suggests a cautious capital allocation strategy. However, the specific prioritization of COSCO’s objectives at PPA remains subject to the strategic decisions made by the leadership team.

This is not the best situation for us as we are not shareholders of COSCO, it is probable that we might not see a buyback program in the future and that the company will reward shareholders via dividends.

8. Taxes:

The Greek corporate income tax rate is at 22%, it has been getting lower during the last decade, however the company has been paying much higher taxes during the couple last years due to an income tax penalty for the fiscal years from 2017 to 2019, the fine has been fully paid as of today and the company will return to paying taxes as usual.

During the year 2022 the company paid 6,345M in tax audit differences, and during 2023 the company paid a final charge of 5,213M.

Because they have already paid all their tax fines the company will post higher profits after taxes, and this might result in a higher dividend for next year.

9. Investment plan:

PPA S.A.'s investment plan is a cornerstone of its strategy to strengthen the Port of Piraeus's role as a major transportation, trade, and tourism hub. Under the Concession Agreement with the Hellenic Republic, the company has committed to mandatory investments totaling approximately €293.8 million during the First Investment Period. These investments are designed to boost both the local and national economy, ensuring the port's continued growth and modernization.

Key Projects Under the Investment Plan

Among the most significant projects is the expansion of the Passenger Port in the Southern Zone, aimed at increasing the port's capacity to handle the growing number of cruise passengers. Progress on this project is well underway, with substantial advance payments made and ongoing construction.

The company is also focused on the repair of Pier I's RMG yard area and cranes, crucial for maintaining operational efficiency. The conversion of the Pentagonal Warehouse into a Cruise Passenger Terminal will further enhance the port's cruise-handling capabilities.

Infrastructure Improvements and Expansion

PPA S.A. is committed to continuous improvement of port infrastructure, including the dredging of the central port to accommodate larger vessels. The Car Terminal expansion, completed at the end of 2023, significantly increases the port's capacity to handle vehicle imports, particularly from China.

Additionally, the construction of an underground road connection between the Car Terminal and the ex-ODDY area will streamline logistics and improve operational efficiency within the port.

10. Financial Performance:

Revenue growth and margins: The company has doubled their revenue since 2014 and has grown their EBITDA margins from 15% to more than 55% as of today. PPA has different sources of revenue apart from container terminals which are cyclical, thanks to the company leasing their biggest terminals and the strong performance of their other business segments, which are less cyclical, they have more stable revenues and margins than other ports.

EBITDA growth: EBITDA has grown from 15.93 in 2014 to 122.09 in the last twelve months. This EBITDA growth has been primarily driven by margin expansion.

Stock price: While the company has doubled their revenues and more than tripled their EBITDA margins the stock has only gone up 59% over the last decade, the P/E multiple of the stock has gone significantly down over the last decade for no apparent reason, offering a great opportunity for value investors.

ROIC: Since the company must make some mandatory investments, it is important to make sure that the return-on-investment capital is high enough to produce shareholder value.

The company has accomplished a ROIC of 23.3% over the last twelve months, their ROIC has been steadily increasing over the last decade demonstrating that the management has been doing a great job at capital allocation.

11. Thesis:

Piraeus Port Authority is a great investment opportunity as it has a wide moat and easy to accomplish goals that will lead to revenue growth. My thesis on the stock is based on these four points:

1. Revenue growth potential: The concession agreement with PCT has significant room for revenue growth, with the potential for increased throughput. Additionally, the expected growth in local cargo, driven by the Greek economy, and the expansion of the car terminal are likely to further boost revenues.

2. EBITDA margin improvements: Pier 1 offers opportunities for EBITDA margin improvements, especially after a challenging period for the European port sector. As market conditions stabilize, this segment could see its profitability increase, aligning with the higher margins that other container terminals have.

3. Tax: With past tax audit differences resolved, the company is expected to return to paying normal corporate taxes, which could positively impact the net income and further strengthen the financial position of the group.

4. Valuation: as the company proves their ability to maintain their margins and continue to grow their facilities and position themselves as one of the biggest ports of Europe, the valuation is likely to increase.

12. Valuation:

To achieve an accurate valuation of Piraeus Port Authority I have forecasted the financials of the company for the next decade with the following assumptions based on my thesis:

Revenue growth: I anticipate revenue growth in 2025 and 2026 as throughput normalizes and the car terminal expansion contributes additional revenue.

EBITDA margin expansion: I expect EBITDA margins to improve to 57%, driven by Pier 1 segment margins increasing to align with the industry average.

Tax rate: I forecast the long-term tax rate to remain stable at 24%.

Exit Valuation: I project the exit valuation of the stock at a 6.5% free cash flow yield, reflecting the company's strong competitive position and consistent dividend payments.

CAPEX: I expect CAPEX to grow at a 10% CAGR until 2028 to support the expansion and completion of the mandatory investment plan. Following this period of intensive investment, I anticipate CAPEX will return to maintenance levels, stabilizing at 7.5% of revenues.

DCF valuation

With these conservative assumptions I have created a model to forecast the future cash flows of the company over the next ten years.

To calculate the current value of the stock and the expected return we will get if we buy the stock, we will use an IRR model and a DCF model.

For the cash flow model, I have used a WACC of 12%.

The current price of the stock looks great under a long-term value investor perspective as it offers a deep discount from intrinsic value.

EBITDA valuation

We could also try to value the company comparing their current valuation to its peers. The company produced 122.09 M of euros in EBITDA over the last twelve months, if we use the average TEV/EBITDA multiple of the sector which is 13.65 if we exclude the multiple of this company in the calculation, we will arrive at a fair value estimate for the whole company of 1666.5 M of euros which divided by the 25 millions of shares outstanding amount to an estimated fair value of the stock of 66.66 euros.

13. Risks:

The main risk related to this investment are these three:

International shipping decline: A downturn in global trade could lead to a significant reduction in throughput at the container terminals, thereby decreasing revenue if international shipping volumes decline due to an economic crisis.

Higher tariffs on Chinese products: Increased tariffs on Chinese goods could negatively impact throughput, leading to reduced revenue from container terminals that handle these products.

Tariffs on Chinese cars: The recent imposition of tariffs on Chinese cars could adversely affect the car terminal's revenue, especially if imports from China decline as a result.

14. Conclusion:

Piraeus Port Authority is a monopolistic company with high margins and significant growth opportunities, capitalizing on the increase in global trade and the improving Greek economy. As the country continues to grow, more local cargo is expected to be shipped through the port, driving revenue growth and enhancing margins. Even if Greece faces economic challenges, the port is likely to continue growing its transshipment volumes.

The port is poised for further expansion, with projects such as the car terminal and cruise terminal expansions. These investments position the port as one of the fastest growing in Europe. Additionally, the container terminal segment is likely to see margin improvements, particularly with Pier 1 becoming more profitable.

This company represents a strong investment opportunity to diversify your portfolio, offering stability in a traditional, non-disruptive sector. Moreover, the current valuation is attractive, with potential for multiple expansion as the market begins to recognize the stock's underlying value.

Nice piece. I hold PPA in my portfolio too. I did this write up on it a few years ago: https://tbifund.wordpress.com/2021/11/22/piraeus-port-authority-ppa-ga-the-gateway/