PGM lowest-quartile costs, net-cash security, and a 3× P/E tag the market can’t keep ignoring.

Why an unlevered miner on a 1× EV/EBITDA multiple could deliver outsized upside as inventories evaporate.

Investment Report on Tharisa Plc

Let me make this quick and easy so I don’t waste your time. PGM prices are at rock-bottom. Supply keeps shrinking, demand is steady, and spot prices now sit below breakeven for most producers, many of whom have already announced production cuts. Inventories are falling fast, yet prices remain stuck while savvy investors wait for the inevitable supply to crunch.

My approach to PGM miners is to target low-cost producers with ample cash, so I’m not hostage to the precise timing of a price rebound. Viewed through that lens, Tharisa looks especially compelling. It offers clean, low-cost exposure to PGMs and meaningful leverage to prices two to four years out, while posting the lowest cash costs of any PGM miner I have examined. Net cash equals about forty per cent of its market capitalisation. The expansion project is set to double production, and the current valuation is almost laughable, roughly three times earnings and one times EV/EBITDA, even at today’s depressed prices.

1. Introduction:

Headquartered in South Africa and still family-owned, Tharisa has two principal assets:

Tharisa Mine – a low-cost open-pit operation in production since 2009.

Karo Mining Project – a tier-one PGM development that is currently absorbing significant capex but could be worth a fortune once prices recover.

More than half of Tharisa’s revenue comes from chrome, providing both diversification and strong cash generation that lets management invest counter-cyclically in the PGM market. At today’s prices, however, the market assigns the Karo Project a steeply negative value, effectively viewing it as a huge gamble and questioning whether management is acting in all shareholders’ interests.

From my perspective, Tharisa offers a low-cost mine generating roughly US $200 million in EBITDA at current prices, plus a world-class project that could be worth multiples of the current market cap if PGM prices bounce. Investors seem fixated on the capex cycle instead of the underlying asset quality and cost structure. For me, the company combines the best aspects of Sylvania Platinum—effectively a negative cash cost for platinum—while adding a leveraged upside through Karo, which we’ll analyse in detail later.

That said, Tharisa is not the one-sided wager it might first appear. In this report we’ll take a cautious approach, explore the key risks, and ask a simple question: Is this stock too cheap to ignore?

Now, let’s dig into the company. I will give you a free, in-depth look at the Tharisa Mine, but the analysis of the Karo Mining Project, along with five additional sections covering topics most analysts ignore, remains behind the paywall. If you are not yet familiar with the broader PGM-market thesis, please read my recent free article on that subject first.

2. Tharisa mine:

Tharisa Mine is an open-pit operation with ≈ 11 years of remaining open-pit life (plus the option to extend underground) that produces both PGMs and chrome from the same orebody—something few mines achieve at commercial scale. This dual-commodity profile lowers unit costs and places the mine firmly in the lowest-cost quartile for both products in South Africa, while the two revenue streams provide a natural hedge against price swings in either metal.

Tharisa’s cash and sustaining capex costs are even lower than those of Sylvania Platinum, my highest conviction holding in the PGM space.

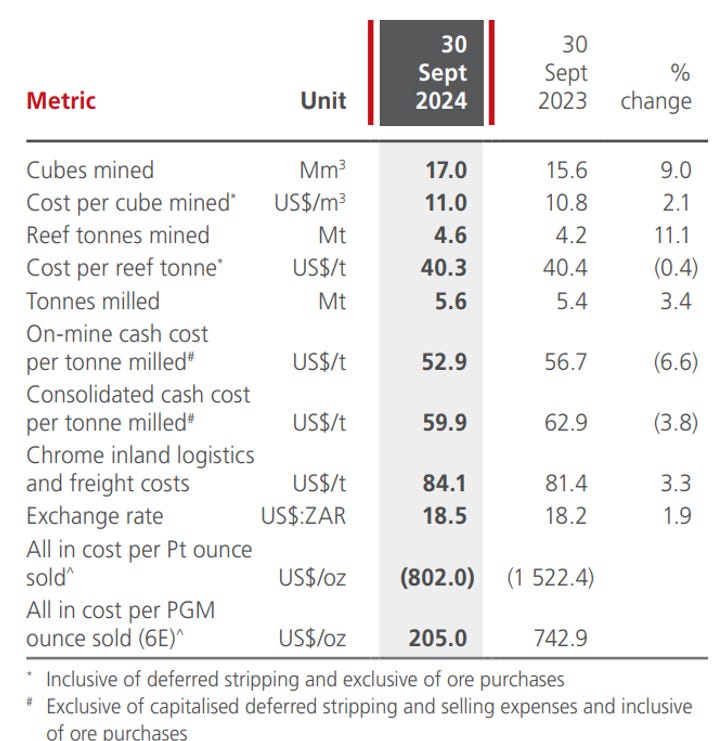

2025 production guidance

6E PGMs: 140–160 koz (realized basket price ≈ US $1,400/oz in the latest quarter)

Chrome concentrate: 1.65–1.80 Mt (realized price ≈ US $235/t LT average closer to 270/t)

Because chrome accounts for a large share of output, margins are less volatile and cash flow is more resilient.

PGM mining disclosure.

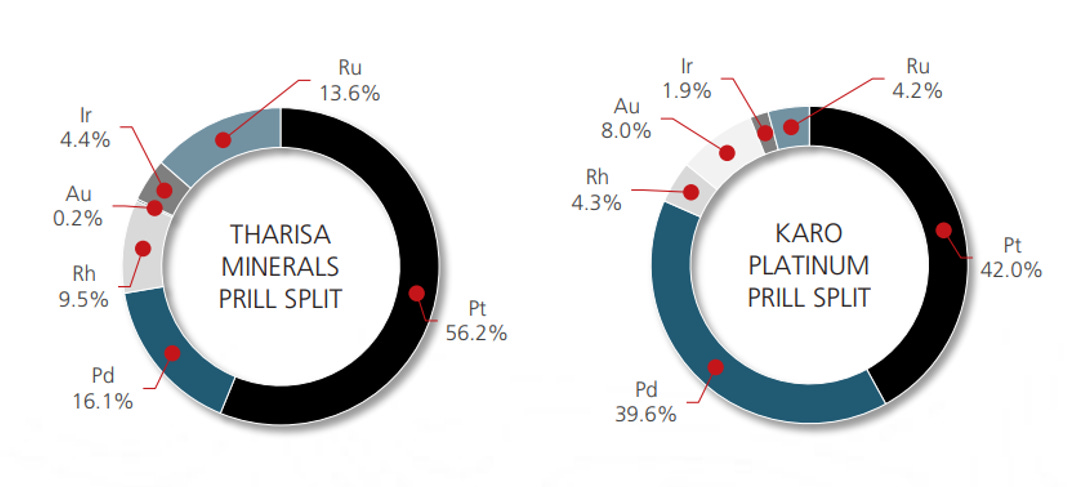

At current metal prices most revenue comes from platinum and rhodium, giving Tharisa healthy exposure to the higher-priced PGMs. Arxo Metals—Tharisa’s R&D arm—aims to lift specialty-grade chrome volumes, further boosting revenue and profitability.

Cost structure

The mine’s economics are extraordinary. On an all-in sustaining basis, every platinum ounce carries a negative cash cost: revenue from chrome and the other five PGMs more than covers all operating and sustaining expenses, so the platinum is effectively produced for free, indeed, better than free, which highlights the depth of the asset’s profitability.

A key risk for any South-African miner is dependence on an unreliable national grid that suffers frequent blackouts. Tharisa is addressing this vulnerability by installing a thirty-megawatt solar plant on site, which should supply roughly thirty percent of its power needs, and by signing a power-purchase agreement with Etana Energy that will wheel wind- and solar-generated electricity to cover a further forty-four percent of demand. Together, these measures should materially reduce exposure to load-shedding.

Tharisa’s processing complex is fully integrated and built for flexibility. Two parallel MG-layer concentrators, Genesis, whose PGM circuit was added in 2011, and the larger Voyager, commissioned in 2012, mill about 5.6 million tonnes of ore each year, comfortably above their original nameplate capacity. The modular design allows entire sections, or even an entire plant, to be taken offline without disrupting overall output. Ore first passes through spirals that strip out chrome, after which PGMs are floated from the chrome tailings; a final stage then recovers additional chrome. Because Tharisa’s PGMs reside in the silicate fraction, the resulting concentrate contains unusually little chrome or base metal, simplifying downstream smelting and refining. Further value comes from two specialised circuits: the in-house-designed Vulcan plant, commissioned in 2021, recovers ultra-fine chrome from live tailings while lowering the operation’s carbon intensity, and the Challenger plant, added in 2013, upgrades a portion of Genesis feed into higher-value chemical- and foundry-grade chrome. Collectively, these facilities give Tharisa a flexible, high-volume platform for co-producing chrome and PGMs at industry-leading costs.

CAPEX

Capital expenditure was unusually high this year because deferred stripping alone absorbed US $112 million. Stripping that item out leaves a more normal spend of roughly US $46.9 million. In 2023, maintenance capex for the mine, excluding R&D, was US $47.3 million, essentially in line with the underlying run-rate. On that basis, it is reasonable to assume about US $50 million a year in routine maintenance. If we add an average of roughly US $20 million a year for deferred stripping—recognizing that this figure fluctuates by period—the total settles around US $70 million. That estimate is deliberately conservative, because the past two years and the year ahead are inflated by the one-off spend required to lift plant capacity and to prepare for the eventual transition to underground mining once the open-pit phase is exhausted.

Mineral reserves of mine:

Tharisa currently mines between five and six million tonnes of ore each year. According to the most recent open-pit reserve statement, dated September 2024, about thirty-three million tonnes remain, containing roughly 1.1 million ounces of PGMs and 5.6 million tonnes of chrome. At the present mining rate, total ore reserves would last for roughly six years, but chrome reserves would not be sufficient to keep annual chrome output at today’s 1.6 to 1.8 million-tonne level, whereas PGM production could continue unchanged. Below the pit lie an additional 41.5 million tonnes of probable underground reserves—a figure that is likely to grow as drilling progresses and the company completes preparatory work for the underground phase.

Beyond these categories, Tharisa reports more than six hundred million tonnes of inferred resources at grades broadly comparable with the current reserve base, suggesting that ore supply should not constrain operations for at least the next decade. Even so, investors should track how quickly inferred material is upgraded to probable and proved status, because the headline resource figure does not automatically translate into mineable tonnes.

It is also crucial to recognise that underground mining is markedly more expensive than open-pit extraction. Industry studies indicate that underground costs can run one-and-a-half to two times higher. Comparable PGM producers such as Silbanye and Zimplats record all-in sustaining costs of roughly nine hundred to twelve hundred US dollars per six-element ounce from their underground operations. Higher underground grades could soften the impact, but total AISC will inevitably rise once Tharisa goes below surface.

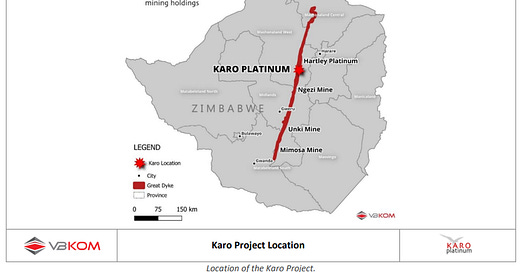

3. Karo project:

Karo is a tier-one, low-cost open-pit PGM asset on Zimbabwe’s Great Dyke that could roughly double Tharisa’s present PGM output. The ground was once held by Zimplats, which never brought it into production; it was later sold to Karo Platinum, an 85 per cent subsidiary of Karo Mining Holdings, itself 76.22 per cent owned by Tharisa plc. When all capital commitments are complete, Tharisa will hold 80 per cent of Karo Platinum and, in economic terms, about 68 per cent of the project. Zimbabwe’s government receives a 15 per cent free-carry interest and retains the option to lift its stake to 26 per cent, yet Tharisa is funding the entire build-out.