Libertas7 Presents an Amazing FY: A Nano Cap at a Huge Discount to NAV

A Look at Strong Fundamentals Driving Real Estate, Tourism, and Investment Growth

Libertas 7 has just reported its fiscal year 2024 results, remaining our largest position in both the fund and the model portfolio. This nano cap real estate company in Spain trades at more than a 60% discount to NAV and has the potential to grow that NAV at high single digits for a long time. The firm closed the year with total consolidated revenues of approximately 7.8 million euros, compared to 13.4 million in 2023, and posted a net profit of about 2.8 million euros, representing a 21% improvement over the prior period. Headquartered in Valencia, it maintains a strategy rooted in prudence, diversification, and a long-term perspective across three primary business units: Real Estate, Tourism, and Investment.

Although real estate deliveries were delayed and there was an extreme weather event (the DANA), the company still achieved strong operational momentum, with an approximately 79% increase in its share price during 2024. The DANA did not cause physical damage to any of the firm’s assets, though it did reduce tourism reservations for a period, and it is not expected to have a lingering effect. For now, the most effective way to value Libertas 7 lies in its NAV per share, as residential developments require multiple years before they are recognized as revenue. There are also less pessimistic approaches to valuation that take into account the company’s capacity to grow its NAV at high single digits.

Libertas 7 combines a recurrent segment and a non-recurrent segment. The recurrent side comprises the tourism division, leasing of office spaces and commercial premises, and dividends from its investment portfolio, all of which amounted to about 5 million euros in revenue during 2024. These stable revenue streams have grown in tandem with the post-COVID recovery in tourism. Now we will analyze the individual segments in more depth to see how they contribute to the overall performance and future prospects of the company.

Real Estate

In 2024, the Real Estate segment, managed under the FICSA brand and encompassing both property development and rentals, posted about 1.3 million euros in revenue, compared to 7.7 million euros in the previous year. This shortfall is explained almost entirely by the absence of large-scale housing deliveries during the period rather than a lack of underlying demand. The activity itself, however, showed a strong foundation and significant growth in assets, doubling the number of houses under management from the previous year.

Throughout 2024, FICSA advanced construction on multiple developments, including Paseo al Mar (95% finished), Residencial Zaïda (65%), Idalia Nature (14%), and Gaia (7%). While these projects are still in progress, they are expected to generate substantial revenue starting in 2025. Two new plots were acquired in the final months of 2024, one in Museros (“Residencial Horta”) for 46 additional residential units and another in central Torrent, designed for at least 160 dwellings. Both projects will begin the formal licensing phase in 2025, significantly enlarging the future pipeline. As of year-end 2024, FICSA had eight active projects in different stages of development, had already pre-sold 31.3 million euros of these houses, and has another 32 million euros in the sale and commercialization phase, double the figure from last year.

Even though no substantial handovers occurred in 2024, the company reported strong demand for upcoming projects. The pre-sales portfolio soared from roughly 13.8 million euros in 2023 to over 32 million euros at the close of 2024. Much of this growth reflects robust property demand in Valencia and the surrounding areas, as well as favorable pricing conditions for FICSA’s mid-to-upper range homes. The market in Valencia remains dynamic, with housing supply well below demand, which supports higher prices. FICSA’s strategy of selecting well-located plots with good transport links and catering to families or second-home buyers has proven effective.

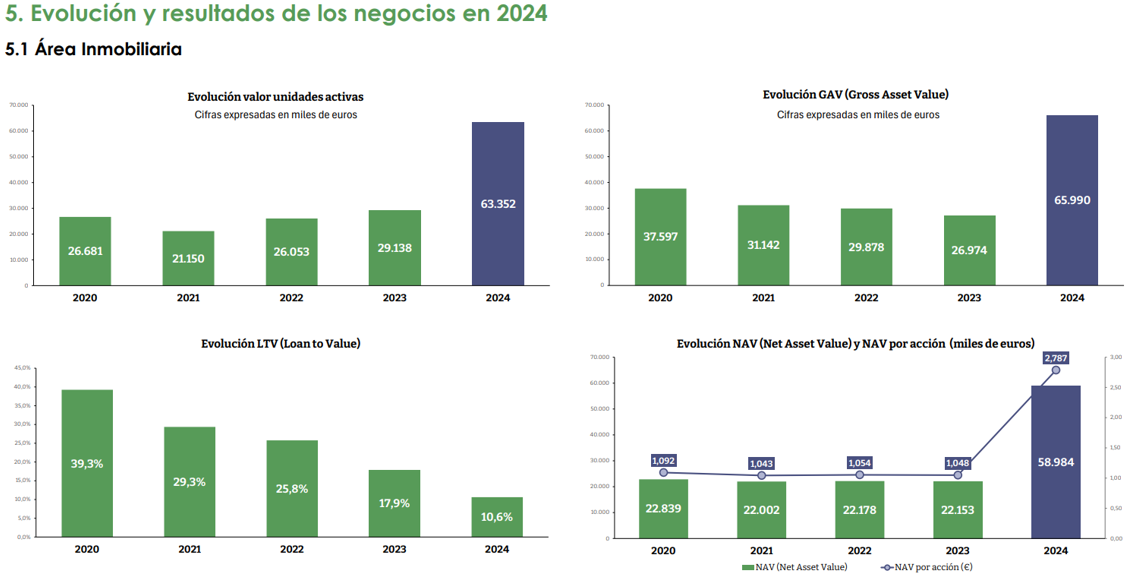

The company is entering what they call a virtous cycle, where they have guaranteed themselves a constant flow of new housing deeds, hoping to deliver between two and three promotions each year starting next year. They had secured new developments through 2028 and, with their new land acquisition, they have secured additional projects for 2029, suggesting that this growth trajectory will continue. The rentals division contributed about 404 thousand euros in recurring revenue, an increase of 9% over 2023, and the company also recovered a one-time payment of 843 thousand euros in previously unpaid rents after a successful eviction process. Independent valuations indicated an uplift of 595 thousand euros across the rental properties, bringing the total fair value of those assets to around 16 million euros. Although top-line revenues dipped, the underlying asset base (Gross Asset Value) for FICSA more than doubled from about 27 million to 66 million euros, driven by new developments and revaluations. Net Asset Value (NAV) reached approximately 59 million euros for this segment, reflecting both the ongoing ramp-up in new construction and rising real estate valuations in Valencia.

I really like how the company showcases the NAV per share of its real estate assets, which highlights how undervalued the company is. As you can see, only the real estate segment has a NAV per share of 2.78 compared to an actual share price of 1.67, a strikingly low valuation.

Tourism

Libertas 7’s Tourism division operates three main holiday apartment buildings called Sea You Apartamentos Port Saplaya just north of Valencia’s downtown, as well as the Sea You Hotel Port Valencia near the city’s historic port. In 2024, the segment’s revenue amounted to around 3.2 million euros, remaining broadly in line with the prior year. The company invested close to 1.7 million euros to renovate the Port Saplaya apartments, focusing on energy efficiency and improving façades, roofs, and climate-control systems. A portion of these works was financed via Next Generation EU funds, and management expects these upgrades to lower utility costs and enhance the guest experience, which could eventually allow for higher average daily rates once the refurbished units are fully operational.

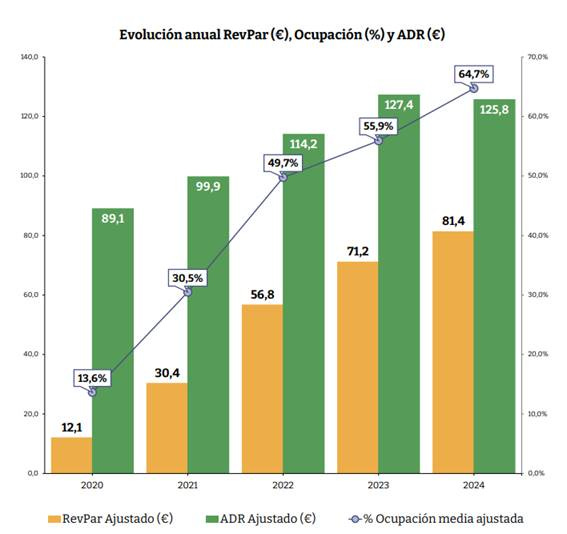

Occupancy for Sea You’s apartments was on the rise until the DANA, an intense storm and flooding event, caused a temporary dip in tourist arrivals late in the year. Despite this setback, the occupancy rate for 2024 across the apartments and the hotel reached approximately 64.7%, with an average daily rate of about 125.8 euros. This resulted in a RevPar (revenue per available room) of about 81.4 euros, helping to maintain stable revenue levels overall. Management anticipates additional gains in occupancy, particularly if off-season bookings continue to rise, and notes that Valencia’s reputation as a cultural and conference destination supports these positive expectations.

The company’s tourism assets were valued from an exploitation standpoint, and both saw positive revaluations, with an expected IRR in the range of 6.25% to 7.5% over the coming decade. Looking ahead, Libertas 7 intends to expand its brand by operating more hotels in Valencia, focusing on mid-sized properties. Management projects that adding another hotel of this scale could generate around 300 thousand dollars in additional income for the tourism division.

Investment

The Investment division oversees a mix of equities and stakes in private ventures, and in 2024 the portfolio’s market value rose to around 62 million euros, a 5% increase compared to 2023, driven by revaluations and new investments. The equity portfolio of roughly 42 million euros yielded an overall return of approximately 4.3%, reflecting Libertas 7’s focus on acquiring companies whose intrinsic value has not yet been fully recognized by the market. On the private side, existing investments delivered higher-than-average returns during 2024, and the company completed a 2.5 million-euro stake in Buenavista Equity Partners, reinforcing a long-term relationship with that investment partner.

Management highlights that the Investment segment serves as a stabilizing element for Libertas 7 by combining liquidity and potential capital gains, mitigating the cyclical fluctuations of real estate and the seasonality inherent in tourism. Some of the firm’s private equity positions began generating meaningful profits in 2024, and these are expected to continue making a positive contribution to consolidated results in subsequent years.

All Together

Libertas 7’s performance in 2024 showed both resilience and a clear commitment to expanding across its three main pillars in the face of certain challenges. The Real Estate segment saw a considerable rise in ongoing developments, which drove a notable increase in Gross Asset Value. At the same time, the Tourism portfolio benefited from significant energy-efficiency upgrades, and the Investment division strengthened its diversification through new holdings. Although the company’s debt level climbed, largely to finance property construction and acquisitions, it remains at a manageable level representing about 24% of total assets, and the firm continues to adopt a cautious stance on leverage that is considerably more conservative than is typical for purely real estate-focused operations.

Looking ahead, management expects to see substantially larger revenues beginning as early as the first quarter of 2025 and extending through 2028, once real estate handovers commence. In the Tourism segment, newly renovated properties position the company to capitalize on higher occupancy rates and refined pricing strategies, provided that weather-related disruptions do not persist. Meanwhile, the Investment division will continue to concentrate on well-researched prospects in both public and private arenas, particularly those aligned with the company’s value-oriented approach. Combining strong asset appreciation, prudent leverage, and growing brand recognition, Libertas 7 appears set for further value creation and a wider profile among investors.

Valuation:

Valuation involves starting with the company’s NAV and comparing it to the current market cap of 37.47 million euros, while Libertas 7’s NAV stands at 96.9 million euros, or 95.34 million if intangibles are deducted. The total assets grew by 9% year over year, and NAV increased by 1.4%, mainly because the company raised some short-term debt to finance acquisitions. Despite this modest NAV growth, the stock still trades at a marked discount, almost a 3x difference, but fair value may in fact exceed the stated NAV. Thanks to strong organic expansion and several significant growth levers in the real estate, tourism, and investment segments, it seems reasonable to argue for a premium over NAV.

The real estate segment combines mid-single-digit yields on the properties with mid-to-low single-digit revaluation potential, suggesting around 8% organic growth. Added to that is the expected contribution from development projects, which could deliver an additional 3 to 5 million euros in EBITDA as early as next year. The tourism division should register similar 8% organic growth from its existing properties, aided by the possibility of expanding into new hotels under the Sea You brand. In the investment portfolio, an 8% annual return over the long run appears attainable, in line with the company’s historical track record and value-oriented strategy. Altogether, these three lines of business seem poised to grow at high single digits, with meaningful upside potential, forming what appears to be a well-managed, inherently low-risk enterprise that is trading at a steep discount to its fundamental worth.

Disclaimer:

The information provided in this article is for informational purposes only and should not be considered financial advice. The content does not constitute a recommendation to buy, sell, or hold any security or investment. Always do your own research and consult with a professional financial advisor before making any investment decisions. Investing in stocks involves risk, including the potential loss of principal. Past performance is not indicative of future results.

Interesting. What's the catalyst to unlock value here?