International Personal Finance (IPF): Capitalizing on a 25% FCF Yield and 10% Growth Potential

Conservative Lending, High Returns: The IPF Opportunity

Investment Report

Key points:

Dominant in Southern Europe, Mexico, and Australia, targeting customers with limited access to traditional credit.

Currently trades at a deep discount to tangible book value, with a 25% FCF yield.

Offers a robust dividend yield of around 7–8%, plus announced buybacks equal to nearly 5% of the market cap.

Targets 10% annual growth in net receivables, fueling consistent revenue expansion without overextending into risky debt.

1. Introduction:

I will make this easy for you: a 25% FCF yield, a 16% ROIC, and a deep discount to tangible book value supported by highly liquid loans that expire in less than 14 months, combined with low impairment rates in non-prime lending and an attractive dividend yield of almost 8%. Are you interested yet? I present to you IPF, a below the radar but attractive investment opportunity in the non-prime lending industry. The company is headquartered in London but operates in Eastern Europe, Mexico, and Australia. If you thought it is so cheaply valued because it has stagnated, you are far off—its topline is expected to grow at a 10% CAGR over the next few years.

So, what creates this opportunity? The company is not easy to find on a screener because it has some accounting complexities related to book value and FCF. It also operates in a heavily regulated market, which can seem uncertain. However, uncertainty is not the same as risk, and the company benefits greatly from this environment, as it helps maintain its leadership position while many new players fail to enter the industry.

2. Business model:

The company is the market leader in Eastern Europe for providing financial services to underserved customers who do not have access to traditional credit. It is profitable and has a good ROIC. Essentially, it lends to people who lack stable incomes and do not meet the requirements for traditional credit and banking services. The business generally involves lending cash for an average duration of slightly more than a year. Agents visit borrowers’ homes to assess their living conditions—a crucial factor in determining if they can repay the loan. Often, these individuals live in decent houses, own a car but struggle to access traditional banking services due to unstable or highly seasonal incomes.

When deciding whether to lend money and how much, the agent’s experience is supported by a computer software system. An interesting point is that agents always have the final say on whether to lend (and how much), and since they are paid based on the amount recovered, they tend to be more cautious—something reflected in the current impairment rate, which sits below 10%.

Their agent strategy is also noteworthy. In many of the traditional countries where the company operates, women typically manage the household and control the family’s finances. Thus, most of their agents are women, many of whom were good clients in the past. Impairment rates are lower because people feel more ashamed not to repay an individual they know rather than an institution. This is further compounded by the fact that many of these women live in the same neighborhoods they serve, which reduces non-payment risk—borrowers do not want to face the embarrassment of defaulting on a neighbor they will likely see at church or around the community.

The company has three main business segments: European home credit, Mexico home credit, and IPF Digital, with most of its revenue coming from the home credit segment. It currently operates across nine markets: Estonia, Latvia, Lithuania, Poland, Czech Republic, Hungary, Romania, Australia, and Mexico.

According to the annual presentation, Europe is the safest, most cash-generative business and can be viewed as the company’s cash cow. Mexico is one of its newest markets with high expansion potential, while IPF Digital has been integrated into existing markets.

The company operates in a heavily regulated industry, which is logical given that it lends money to people in challenging economic circumstances. Governments tend to be strict in this sector, but this creates opportunities and gives the company a competitive advantage over new entrants. It is important to note that regulatory hurdles will arise in the future, leading to varying levels of volatility. However, the company has operated in this market for over three decades, demonstrating its ability to adapt in the past and likely to do so in the future.

3. Company clientele:

Most of the company’s customers are middle-aged women with low to medium incomes, children, and limited credit history. There is also an increasing number of younger borrowers in their teens and twenties who live in larger cities and struggle with low savings. Because many of these clients have unstable incomes and lack formal credit histories, they turn to IPF for financing when they need funds for healthcare, education, small investments in their micro-businesses, or extra money for holidays.

The average loan amount is typically small—less than a thousand pounds in Europe and slightly more than 300 pounds in Mexico. In the IPF Digital segment, the company usually provides a credit line exceeding one thousand dollars, with the average installment loan being just over six hundred dollars.

4. Competitive advantages:

At first glance, it might seem that the company faces multiple competitors. However, these competitors are often a low threat because they appear quickly and disappear just as fast. In the non-prime lending market, many startups and businesses emerge, trying to lend as much as possible to anyone who wants money. This approach can lead to rapid growth and even attract venture capital or other investors. But when times get tough or regulations change, these competitors typically crumble under the weight of their low-quality loans and go out of business.

By contrast, IPF focuses on stability, lending only to prospects it considers genuinely creditworthy. The company is not in a rush to grant loans, and its employees are compensated based on collections rather than total loan volume. This allows IPF to weather mild economic downturns or regulatory shifts, strengthening its brand over the long run and positioning itself as both a market leader and a trustworthy lender.

Additionally, the company takes an unusual approach to customer care, striving to be ethical and lend responsibly. Although it could charge higher interest rates—given that many clients have no other credit options—IPF chooses not to, as it believes doing so would hurt its customers, increase impairments, damage its reputation, and potentially attract regulatory issues. Typically, loans last just over a year to give clients breathing room for repayment. The company does not charge extra if a payment is late by a week, understanding that occasional setbacks can happen. Instead, it provides an additional few weeks to complete payments. If clients repay faster, it benefits everyone, and if they pay on time, there is no penalty.

I find this model appealing because a business that does not create a win-win scenario for both itself and its customers will likely struggle to maintain its leadership position in the long term. IPF’s approach fosters loyalty and a strong customer base.

5. Business metrics

KPIs:

Impairment rates:

IPF has shown notable improvement in its impairment metrics over recent reporting periods. According to its Q3 2024 trading update, the Group’s annual impairment rate improved by 2.8 percentage points year-on-year to 9.2%. This trend continued through the end of 2024, with the full-year financial report indicating an impairment rate of 9.6%, representing a 2.6 percentage point improvement from 12.2% in 2023.

Notably, IPF’s current impairment rate of 9.6% is below its own target range of 16% to 18%. This suggests that the company’s credit performance is surpassing its expectations, potentially paving the way for more aggressive growth strategies while maintaining profitability. The lower impairment rates are primarily driven by a reduction in lending in Poland, where new regulations on allowable interest rates forced the company to change its approach and shift toward the use of credit cards.

Revenue yield

Although revenue yield has been slightly below the company’s target range, it has been steadily improving in recent years. With the growth initiatives planned for the coming years, it is expected that revenue yield will continue to move closer to the company’s target.

Cost-income ratio

The company is targeting a cost-income ratio of 49% to 51%. Last year’s figure was 57%. Management primarily attributes this higher ratio to reduced revenues in Poland, which they believe will improve next year as volumes recover, having been during transition to a credit card model. Additionally, ongoing investments in technology and AI are expected to enhance efficiency, further lowering the cost-income ratio.

RoRe

A key reported metric is the Pre-exceptional Return on Required Equity (RoRe), which is effectively an equivalent of ROIC. IPF has maintained an ROIC around 15% in recent years. Looking ahead, returns are expected to range between 15% and 20% as markets consolidate and the company refinances some debt at lower rates.

RoRe is broken down among the Mexico and European home credit segments, as well as IPF Digital. Both Mexico and Europe have RoRe values around 20%, with Europe at 19.9% (down from 21.6% in 2023) and Mexico at 24.4% (up from 20.7% in 2023). IPF Digital trails behind at 11.4%, though it has risen significantly from 5.6% in 2023, indicating margins are catching up with the other two segments. Overall, the group’s RoRe stands at approximately 15.7% (up from 14.8% last year), and this should continue to rise as IPF Digital gains volume, aided by its new credit card license, and further improves margins.

Revenue growth

The company’s revenue dropped considerably during the COVID pandemic, but it is currently reaccelerating, and we should see an average growth of 10% in revenues over the next few years.

Free cash flow

Calculating cash flow for this company is not straightforward. Each year, IPF increases its accounts receivable as a reinvestment in growth. To calculate a more accurate FCF figure, one can start with net income, add D&A and amortization of deferred charges, then subtract stock-based compensation and CAPEX.

Using this approach, the company generated £82.1 million in free cash flow last year. With a market cap of £330 million, this represents a yield of 24.9%—a substantial figure for a business likely to maintain a 10% CAGR.

Debt

Debt plays a critical role in the company’s growth strategy. Much like a bank, IPF borrows funds at one interest rate and lends at a higher one. Recently, the company has refinanced some debt at more favorable rates, which should help improve margins or enable it to offer lower rates to customers—an advantage in the eyes of regulators.

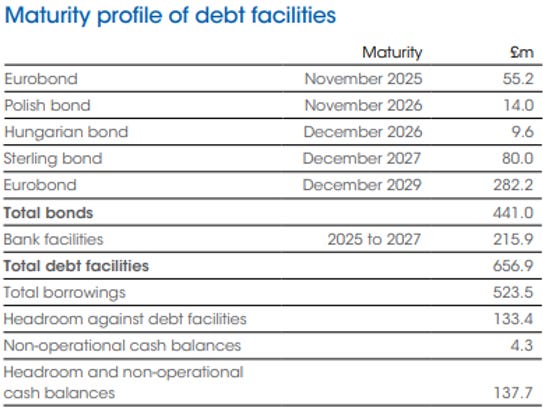

On many screeners, IPF appears to have high leverage, with an EV of over £800 million. However, this can be misleading. The company’s total debt facilities amount to £657 million, split into £441 million of bonds and £216 million of bank facilities. Total borrowings are £524 million, most of which mature after 2025, thanks to the recent refinancing of £341 million in Eurobonds. Of these, £274 million were redeemed, leaving £67 million set to mature this November.

On the asset side, IPF holds £27.6 million in total cash and short-term receivables, along with £654 million in receivables due in less than 12 months and £245.6 million in long-term receivables (just over 12 months). The company closed 2024 with £870 million in receivables.

NAV

By subtracting total debt from total receivables, we arrive at £346 million in loans, compared to a market cap of £328 million. Adding the £27.6 million in cash and the £106.7 million results in a “NAV” of £480.3 million. This suggests the company is trading at a substantial discount to its NAV, even though it has demonstrated an ability to reinvest capital effectively.

The discount to NAV becomes even more pronounced when one considers that net receivables are calculated after a loss allowance exceeding 30%, while the company’s own target impairment rate is 14% to 16%. Because net receivables are calculated as if they would be impaired by more than 30%, yet actual results have been lower, there could be an additional £230 million in receivables not reflected on the balance sheet. This implies the company is trading at an even deeper discount in reality.

6. Capital allocation:

The company’s capital allocation strategy is straightforward. It uses its free cash flow to pay a dividend of at least 40% of net profits, then aims to grow its net receivables by 10% each year. This approach allows it to expand without frequently accessing debt markets. However, the company is still open to taking on debt because borrowing at around 9% and lending at a RoRe of 15–20% is highly accretive.

Currently trading at a 25% FCF yield, the company offers a dividend slightly above 7%. After funding growth, there is still enough cash left for share buybacks. Recently, a £15 million buyback program was approved—equivalent to roughly 5% of the company’s market cap.

7. Poland and credit cards:

During 2014–2016, the company’s share price declined sharply, primarily because Poland changed its regulations related to cash lending, capping the maximum rates that lenders could charge. Since Poland was the company’s main market, growth slowed, profits dropped, uncertainty rose, and the stock price fell significantly.

Nonetheless, IPF managed to overcome these regulatory obstacles and emerge stronger. When cash interest rates were capped, the company shifted from cash lending to credit cards. While some might view this as risky, it appears to be a strategic move that leaves IPF better positioned than before. Furthermore, credit cards enable the company to collect more data on customer spending, potentially helping it build more accurate “credit scores” and offering future upside.

Poland is a clear example of how the company can navigate regulatory hurdles and come out stronger. Recently, IPF received a new license to expand its credit card offering, regaining momentum in Poland and other European countries. As stated in the latest annual report:

“The new licence offers significant growth potential for our new credit card offering, both in Poland and beyond. While our credit card created a completely new market and was proving extremely popular with customers with 130,000 cards issued by the end of 2023, we were forced to limit the amount of lending in 2024 under the rules of the old licence. The granting of the new licence in November means these restrictions have been taken away and my colleagues in Poland are really looking forward to accelerating growth. We are focusing our initial efforts on offering existing customers increased credit lines if they require them, and we began to market credit cards to new customers early in 2025. The new licence is passportable to other European countries and we are exploring the potential to introduce our credit card into our other markets.”

8. Growth strategy:

The company is currently implementing its "Next Gen" strategy, aiming to increase the total customers served to 2.5 million. Management estimates that more than 70 million people are underserved in the markets where it operates, indicating a large addressable market (TAM). In earnings calls, the company emphasizes that it is pleased when a customer no longer needs its services because they have moved to a better financial position—this dynamic strengthens the brand, and there will always be people in need of credit. Incidentally, while a significant number of Digital applications are rejected, many of these are followed up via the more traditional method and subsequently approved once qualified manually.

In 2024, the company introduced a mobile app in Mexico and expanded its presence in both Romania and Mexico through retail partnerships. Growth in Mexico’s home credit business was slower in the second half of the year due to two key issues: underperformance in the Sureste and Norte regions, and a temporary reversion to manual field operations during an IT platform upgrade. According to management, these challenges have largely been addressed, and they anticipate accelerating growth in 2025.

Looking ahead to 2025, growth is expected to pick up again in Poland, supported by the new payment license that will enable faster expansion. Mexico is also projected to rebound as the company moves into new territories without the hurdles experienced in 2024. Technology investments remain a critical component of maintaining a market-leading position, as customers increasingly demand better applications, enhanced call-center support, and improved overall customer experience. These tech enhancements are driven by data and AI, providing efficiency gains that benefit both the company and its customers.

Banking License

Management has often discussed the possibility of obtaining a banking license, which could be a logical next step for the business. Such a license would likely improve investors’ perceptions of the company and reduce its susceptibility to regulatory changes. It could also enable borrowing at lower rates, although those margin gains might be offset by higher regulatory costs. One likely approach would be acquiring a small bank at a reasonable price, primarily to leverage its existing license. This development could serve as a major catalyst for significant valuation expansion.